“An election is coming. Universal peace is declared, and the foxes have a sincere interest in prolonging the lives of the poultry.” George Eliot.

“Politicians and diapers should be changed frequently and all for the same reason.” José Maria de Eça de Queiroz.

“Win or lose, we go shopping after the election.” Imelda Marcos.

“We have a Presidential election coming up and the big problem, of course, is that someone will win.” Barry Crimmins.

Comments like these indicate that the voting public greets elections with not a little irony. Caution might be a better sentiment. In the next 15 months, the global business community faces a wave of elections that could potentially change the investing landscape. The nature of these changes is the focus of the next annual University of Virginia Investing Conference, “The Political Cycle, Political Change, and Investing,” forthcoming on November 10-11. The program features a worthy lineup of speakers, including George Tenet, the former Director of Central Intelligence for the United States Central Intelligence Agency, Peter Fisher, former Under Secretary of the U.S. Treasury, Tom Keene, editor at large for Bloomberg News, Vincent Reinhart, Chief U.S. Economist for Morgan Stanley, and ten others. The aim of this year’s conference is to explore the impact of political change on the investing climate for equities, fixed income securities, commodities, real estate, and other asset classes. There will be plenty to discuss.

Why is 2012 Significant?

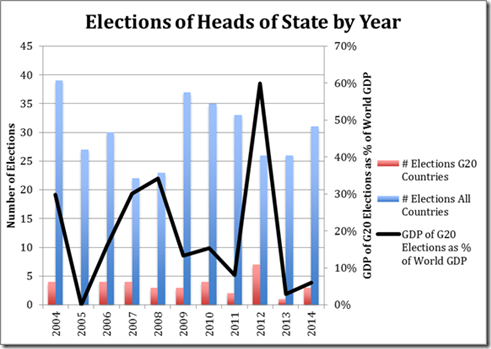

Like it or not, government policies affect investment returns. Therefore, changes in rulers and their policies bear close scrutiny. The year ahead will be noteworthy. According to ElectionGuide, 26 countries will elect a head of state in 2012. As the following figure shows, 20 to 40 countries elect heads of state in a typical year. What sets 2012 apart is the number of elections in economically significant countries: United States, China, Russia, France, Mexico, India, Korea, and Turkey. When you aggregate the Gross Domestic Products (GDP) of those G20 countries facing elections, they account for about 60% of the world GDP in 2012, much more than in recent years.

In this graph, the three peaks of GDP of those G20 countries facing elections (2004, 2008, 2012) are associated with the Presidential elections in the United States, the largest economy in the world. But the peak in 2012 is an extreme outlier, owing to the convergence of elections in several large countries.

In addition to the volume of significant elections coming up, we have the special intensity of the issues on the table. The elephant in the room is the fact that for many countries, this is the first major election cycle since the onset of the Global Financial Crisis and Great Recession. Judging from street demonstrations and the rise of populist movements in various countries, the voters are Very Angry. This alone generates more than a little uncertainty regarding government policy changes and investment climate ahead.

Then too, local conditions promise to add more theatre to the electoral process.

· United States. President Barack Obama has some of the lowest approval ratings in opinion polls, beaten only by the lower approval ratings of the U.S. Congress.

· China. What may look like a very orderly election process is being fought out intensively at the municipal level right now. The Communist Party is divided into camps that favor (a) continuation of the liberalization of the economy and culture or (b) stasis. Similar divisions are occurring around military and foreign policies.

· France will hold the election of its next President next spring. Like Obama in the U.S., Nicholas Sarkozy is lagging in the opinion polls, suggesting that France might again have a socialist President.

· Japan has just elected its fifth Prime Minister in five years, political turmoil dwarfed only by the tsunami and meltdown at Fukushima. Given the steadily revolving door, it is very hard to handicap the nature and effectiveness of any economic recovery policy that might be enacted.

· Venezuela has not held meaningfully free elections in a long while. But if the illness of Hugo Chavez worsens, Venezuela could experience an unexpected change in policy.

· Middle East. The Jasmine Revolution is rewriting the conventional wisdom about that region’s political trends, growth, and oil production. Iran is bankrolling a range of terror and military efforts, including the development of nuclear weapons. Israel is suddenly feeling more vulnerable.

I could go on and on, but you get the picture. Interesting times, no?

So What?

Your investment returns may be in for a bumpy ride. Research finds strong associations between the political cycle and macroeconomic conditions, investment returns, and business behavior.

· Variations in monetary policy and government fiscal restraint. Kenneth Rogoff wrote in 1990, “During election years, governments at all levels often engage in a consumption binge in which taxes are cut, transfers are raised, and government spending is distorted toward projects with high immediate visibility.” This thesis has a legendary heritage, reaching back to Karl Marx’s Communist Manifesto, published in 1867. Investment manager, Jeremy Grantham, is a prominent analyst of the political cycles in fiscal and monetary policy. He wrote, “Nowhere is this power [of the Fed] more clearly revealed than in the ease with which it can move asset prices, particularly stock prices, and nowhere is this revealed more clearly than in Year 3 of the Presidential Cycle.” A four-year U.S. stock market cycle associated with the timing of Presidential elections seems to have become a part of the investment landscape since the mid-twentieth century.

· Variations in policies owing to shifts from left to right and back again. Parties on the left tend to favor full employment. Parties on the right tend to favor inflation fighting. In America, markets tend to rise higher under Democratic rather than Republican Presidential administrations.

· Variations in corporate investing. In a recent study, Art Durnev wrote, “Election uncertainty leads to inefficient capital allocation, reducing company performance.”

What next?

The dominant question is whether the regularities of the political cycle will obtain in 2012. Sir John Templeton said that the four most dangerous words in investing are, “This time it’s different.” Yet there is plenty to argue that 2012 may indeed depart from historical patterns: the world remains in the grip of low growth following the Global Financial Crisis and Great Recession; households and consumers are reducing spending to repay debt; central banks are pursuing stimulative monetary policies and probably cannot push further; governments face enormous debt burdens and are reluctant to borrow-and-spend to stimulate their economies. From the perspective of economic history, this is a dramatic moment.

Come to the University of Virginia Investing Conference to hear what some well-informed experts and canny investment managers have to say about this situation.