On November 14-15 (this Thursday and Friday) Darden will host the sixth annual University of Virginia Investing Conference (UVIC). As we get ready to welcome the world-class speakers and participants, we look forward to insights on a range of questions relevant to investors, business executives, faculty, and students.

Over the years we have enjoyed robust attendance at the conference. Participants tell us that they seek fresh ideas from speakers about current conditions and the future outlook. And participants gain opportunities to network at our receptions and breaks. An important role that universities play is to convene and debate differing perspectives. Every year, the financial markets offer fresh puzzles, which means that each new conference holds fresh insights for decision-makers. We welcome the several hundred registrants who will come to our Grounds—a few walk-in places remain for the procrastinator.

Here are some focal questions for speakers and participants at this year’s conference.

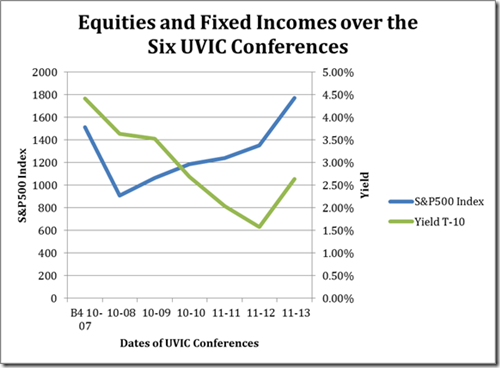

1. Is 2013 a pivot-point or a head-fake? In the graph that follows, you see the level of the S&P500 Index and the yield on the 10-year Treasury Bond at each of the dates of our UVIC. At UVIC 2012, the speakers were especially down-beat about the future of investing. But something remarkable happened in equities in 2013: the S&P500 Index returned to levels last seen before the Global Financial Crisis. Note also that yields on 10-year Treasury bonds edged upward, probably in anticipation of the Fed’s “tapering” away from quantitative easing. Are these results for 2013 just aberrations, or are they the beginning of a trend?

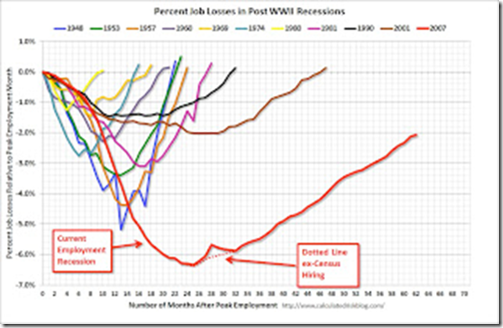

2. Is the market’s current buoyancy rooted in reality? Think of Twitter’s recent blow-out IPO. In 2013, Michael Dell took his namesake company private for $24.4 billion; Warren Buffett bought H.J. Heinz for $23 billion; Publicis and Omnicom announced a merger at $35.1 billion; and Verizon bought out Vodaphone’s share of a joint venture for $130 billion. What do these players see in the fundamentals that the rest of us may not be seeing? The glaring dampener to any assertion about the market’s rise are the following graphs, which show that the recovery of jobs from the recent recession is agonizingly deeper and slower than any post-WWII recession.

3. Is the economy in a financial “bubble” again? The concept of a market “bubble” is gaining currency again. In previous posts I have written about bubble “mentions” (see this, this, this, and this). Our speakers will be well-suited to comment on bubble concerns.

4. Whether or not the financial markets are pivoting, what will be the attractive sectors and industries for the foreseeable future? In contrast to earlier UVICs, we have asked our speakers not only to sober us up with the harsh reality of the day, but also to suggest where might be the opportunities to earn positive returns in this environment. Accordingly, we are convening sessions on specific sectors, including energy, technology, and alternative assets.

These questions bespeak fundamental issues about asset allocation, stock picking, and risk management. The speakers will be most enlightening. Join us.

Guest Speakers Will Include:

Keynote Addresses:

- Joyce Chang, Global Head of Fixed Income Research, JP Morgan Securities LLC

- Richard Chilton, Chairman & CEO, Chilton Investment Company

- Tony Crescenzi, Executive Vice President, Market Strategist and Portfolio Manager, PIMCO

- Howard Marks, Chairman, Oaktree

- Jason DeSena Trennert, Managing Partner, Chairman & CEO, Strategas Research Partners LLC

Endowment Panel:

- Larry Kochard, Chief Executive Officer and Chief Investment Officer, UVIMCO

- Donald W. Lindsey, Chief Investment Officer, The George Washington University

- Scott Malpass, Vice President and Chief Investment Officer, University of Notre Dame

- D. Ellen Shuman, Former Vice President and Chief Investment Officer, Carnegie Corporation

Energy Panel:

- Kyle Bass, Managing Partner, Hayman Capital Management LP

- Joseph "Jody" A. LaNasa III, Managing Partner, Serengeti Asset Management

- Wil VanLoh, President & CEO, Quantum Energy Partners

- Michael Watzky, Managing Partner, BP Natural Gas Opportunity Partners, LP

Technology Panel:

- Shelby Bonnie, Managing Director, Allen & Company

- Henry Ellenbogen, Portfolio Manager, T. Rowe Price

- Scott Ferber, CEO, Videology

- Ned Hooper, Partner, Centerview Capital