This begins a running commentary that parallels a new course that I’ve started at Darden, “Financial Innovation: Opportunities and Problems.” On August 22nd, we kicked off the course, and developed themes.

1. The huge range and breadth of “financial innovation.” I took students through a number of fictional “elevator pitches” (short appeals for funding by entrepreneurs to investors) that illustrated the immensity of financial innovation today and in history. The term, “financial innovation,” covers “financial engineering,” (a somewhat disfavored term these days) and “fintech,” uses digital technology, artificial intelligence, machine learning, blockchain technology and others to provide new financial products and services. Though we can try to “bucket” innovations in terms of new markets, new institutions, new instruments and new services, we confronted the fact that most innovations are idiosyncratic—they color outside the lines in ways that defy simple categorization. The idiosyncrasy of financial innovation is both a curse and a blessing. It brings forward interesting new products and services and makes the lives of individual and corporate consumers, financial institutions, regulators, entrants, and incumbents less certain and more interesting.

2. Motivation to study financial innovation. Students are showing increased interest in financial innovation as related to their studies and career interests. “Fintech” is attracting entrepreneurs and venture capital in growing volumes. Pundits assert that Bitcoin (and other cryptocurrencies) and the underlying blockchain technology will revolutionize finance. The subject is relevant to the economy and society as an influence on the stability of the financial system. And financial innovation retains a prominent place in current political and policy debates—a government report in 2011 accused financial innovation as a prominent cause of the Panic of 2008. In 2009, former Fed Chairman, Paul Volcker, said, “The most important financial innovation that I have seen the past 20 years is the automatic teller machine…I have found very little evidence that vast amounts of innovation in financial markets in recent years has had a visible effect on the productivity of the economy” ((Paul Volcker, quoted in New York Post, December 13, 2009, accessed at http://nypost.com/2009/12/13/the-only-thing-useful-banks-have-invented-in-20-years-is-the-atm/. )) All of this warrants careful examination.

3. Current stuff and history. This course turns to a blend of current topics and examples in history to illuminate financial innovation. There are plenty of financial innovations in the current environment to fill a course. But looking only at current events forsakes a grasp of consequences. It is the longer-range outcomes of financial innovations that help you build a critical point of view about them. Also, history grants the kind of perspective that can help you understand the future. For instance, history shows that innovation tends to come from the periphery of finance, not the center; it seems to increase in times of social and political change rather than in quiescent periods; and it tends to be led by entrepreneurial visionaries rather than pushed by the general market. Studying important financial innovations of the past can help you assess the present to anticipate opportunities and problems in financial innovations to come.

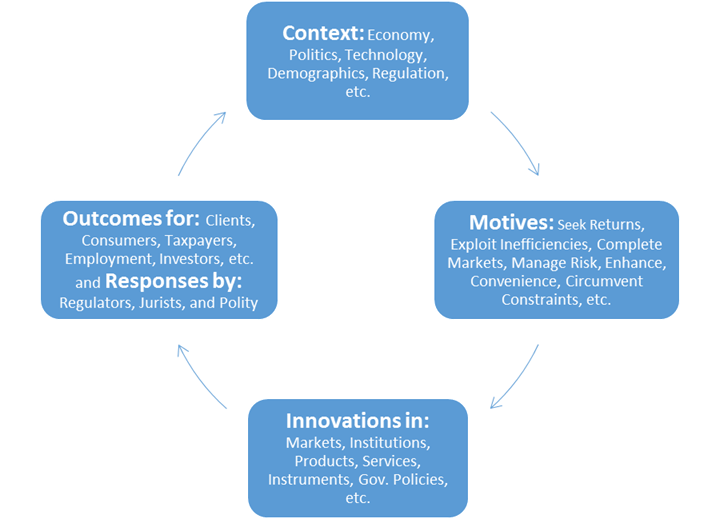

4. What stimulates financial innovation? This is a question with which we will deal throughout the semester. Our discussion this week suggested that the business and economic context creates challenges and opportunities for financial innovators. The innovators respond with proposals for new markets, institutions, products/services, instruments, technologies—and even government policies (both private- and public-sector financial entrepreneurs design these). These innovations ultimately create outcomes for consumers, taxpayers, investors, issuers of securities, employment, the voting public, and the stability of the financial system. Government policies interact significantly with financial innovation, either ex post, in the form of regulations of markets, institutions, and instruments, or ex ante, in the form of incentives or constraints to which innovators respond. The course will aim to illuminate the interaction between financial innovations and government policies.

5. Is the blockchain a genuine revolution-in-the-making, or just a lot of hype? We explored blockchain technology and its potential application in financial innovations—our resource here was the book, Blockchain Revolution, by Tapscott and Tapscott. And we read the foundational document by the mysterious Satoshi Nakamoto, “Bitcoin: A Peer-to-Peer Electronic Cash System.” The blockchain technology offers many appealing features: lower cost, faster speed, encryption, open source, greater privacy, and potentially increased systemic resilience. And blockchain’s advocates argue that it will disrupt the financial sector profoundly, as well as other sectors such as transportation, energy, resource extraction, health care, retailing, record-keeping, and the “factory of things.” But sober assessments (such as a critical piece by David Evans of University of Chicago) suggest that the blockchain won’t eliminate intermediaries, that Bitcoin is not a medium of exchange (it is an investment asset) and will have a volatile value with uncertain expectations, and that the evolution of blockchain technology depends on the adaptation of new systems of governance. And finally, students (and I) admitted that the actual functioning of blockchain technology remains inaccessible to the businessperson—you need a grounding in computer science to really understand what is going on. But do we need to master the technical functioning of the Internet in order to start an online business?

All of these themes warrant deeper consideration, which the balance of the course will explore.