But now it looks to me as though I was following a path that was laid out for me, unbroken, and maybe even as straight as possible, from one end to the other, and I have this feeling, which never leaves me anymore, that I have been led.

— Jayber Crow, Wendell Berry

This has been a big course: 28 class sessions, about 1,400 pages of required reading, numerous in-class exercises and videos, and eight visiting speakers. And we went off the rails compared to most Darden courses: no case studies, just articles; flat classroom, iLab location; discussions led by students; liveblogging by the instructor; and diverse attendance from Darden, the Law School, the Batten School, and the Economics Department. So, after all of this, where have we come to?

Along the path

Conventional wisdom is that the task of teachers is to get students to a destination of greater mastery. But an unrelenting focus on a destination can lead to rote instruction, teaching to the test, and rather dull learning. Important mastery arises from the process of learning. As Michel de Montaigne said, “It is the journey, not the arrival, that matters.” The most important learnings are about how and why to get somewhere, rather than the “what” of the there that is there. Financial innovation is changing so rapidly that anything one might say about the blockchain or fintech today would be obsolete in a year. Rather, what matters is the ability to ask the right questions, to think critically, and to translate values and analysis into actions. We esteem competent technicians and software engineers, but you can hire those skills. Larger value-added comes from conceiving new markets, institutions, instruments, services, processes, social impacts, and government policies. Through a process of reflection, exercises, and exposure to instructive examples, one grows in the ability to add value through financial innovation. So, the course design reflects an effort to grow that ability.

The result has been this rather unconventional path for the past 14 weeks. It would be the height of hubris to suggest that I laid out the path with certainty about the experience you would have. It’s a messy, dynamic, even chaotic subject—we should question pundits who claim to have it all figured out. Given such disorder, it is wrong for a teacher to impose false order. Therefore, the course embraced the disorder and had to be taught differently. Like taking an inflatable raft down the New River Gorge (I highly recommend it), we wouldn’t stay dry if you depended on me to paddle alone. We all had to pull at the oar. We all had to contribute to making sense about this subject.

Now, the key to success in an enterprise like this is to listen very very hard to what the subject is telling you. Judging from the astute comments you offered in class, you’ve been doing that. These blog posts are evidence of my own listening to the subject. What happens when you learn this way is that the subject pulls you along. As Wendell Berry says, you’re on a path, but you’re actually being led.

In the way of leading, the syllabus to the course listed three objectives. It said, “A great university education entails growth in knowledge, skills, and wisdom. Here’s how this course aims to contribute to that outcome:

· Growth in knowledge about:

o the spectrum of financial innovations over time and currently;

o various stimulants and inhibitors of financial innovation; and

o basic tools, concepts and vocabulary related to financial innovation.

· Growth in skills, such as

o Integrating a range of perspectives, such as finance, economics, system dynamics, law, politics, and history—in doing so, the course exercises the ability of students to integrate learning across disciplines. We will survey a large and growing literature about financial innovation: academic scholarship, professional case studies, and practice-oriented materials.

o Assessing the welfare impact of financial innovations (who wins, who loses?);

o Managing innovation efforts; and

o Constructive criticism of “pitches” and concepts for financial innovations.

By the end of the course, you should be able to think more confidently about and discuss concepts for financial innovations.

· Growth in wisdom, including:

o Social awareness: sensitivity to the context of financial innovation; how market and social sentiment can produce receptivity or rejection for innovations.

o A critical point of view about financial innovations and the opportunities and problems they may present. We will review criticism and defense of financial innovation in general.

o Strategic awareness about the vision, and positioning among competing innovations of financial innovations.

o Ethical awareness about the sustainability, social impact, and success of financial innovations.

o A bias for action: acceptance or rejection of innovations based on the foregoing.”

The course promoted knowledge through the wealth of readings. It promoted skills through the exercises and discussions. And it encouraged wisdom through the reports and discussions. Ultimately, each student is both the author and judge of progress made.

Ending with the system

Our exercise in the last two days of the course focuses on innovations to build stability in the financial system. It’s a fitting conclusion because systemic instability is perhaps the knottiest problem in finance and presents the gravest threat. But as Jerry Seinfeld would say, “Experts are working on this!” (Think of the Financial Stability Oversight Council and others.) Therefore, it may seem presumptuous for us to deign to intrude. Yet such would have been the charge against successful financial innovators over time. Moreover, the invitation to participate in a hackathon on systemic stabilization offers the opportunity to exercise ideas we’ve encountered throughout the course and in other courses as well. One could:

· Tackle causes. Researchers aren’t aligned on exactly what causes financial crises, but explanations that have received the most attention focus on these points.

o Complexity makes it hard for people to know what is going on. In times of stress, the less-informed players in a market begin to imitate the actions of more-informed players. This causes herd-like runs on financial institutions. Therefore, innovate on behalf of simplicity and transparency.

o Connectivity means that trouble can travel. Therefore, innovate on behalf of circuit-breakers, and firewalls.

o External shocks can set in motion the domino-like cascade of a crisis as weak institutions collapse, followed by other institutions. Think of natural disasters, geopolitical events (wars, trade wars, regime changes), and sharp turns in markets outside of the financial sector. We looked at catastrophe bonds. Is it possible to create other kinds of shock absorbers?

· Tackle symptoms. Two of the most prominent symptoms of a serious crisis are market crashes and widespread bank runs. These reflect sharp changes in expectations and confidence. Is it possible to apply the insights of behavioral finance to stop and/or reverse the adverse changes? (Think about “nudges.”)

· Tackle adverse outcomes. Crises damage the financial system, typically leading to a seizing-up of markets and collapse of credit, the life-blood of commerce. Financial crises spill over into the real economy and cause extensive damage. Think of unemployment, consumer hoarding (rather than spending), cuts in capital spending, and negative GDP growth.

A “hackathon” is a brainstorming session. Let’s see what you can do with this challenge.

Coda

In the way of closure for the course, you may hanker for a grand summary of the blog posts and class sessions. But that would be a waste of time. The student leader reports on each class and the blog posts are already in your hands. And what is more important is the meaning that you, yourself, make of the course. Rather, consider three final reflections.

Invention, imitation, and innovation. The course focused on the word, innovation, but repeatedly chafed at the edges of invention and imitation. Imitation is pervasive in this field. The vast number of fintech elevator pitches I’ve heard aren’t inventions or innovations. They are bald imitations. Learn to parse the original from the duplicate. Innovation, as dictionaries define it, is the commercialization of inventions. But in finance, the boundary between invention and innovation is permeable. John Law, Jerry Nemorin, Robert Shiller, and Doug Lebda were simultaneously inventors and innovators. The invention/innovation difference is artificial. Instead, think of it as a unified activity. This matters because the process of creating social and financial value makes more sense that way. For instance, where should you seek out the creation of new markets, institutions, instruments, processes, social impact and regulations? It seems that players on the periphery invent and innovate and that big, established incumbents carry forward the innovation to higher scale. Innovation tends to originate in the periphery of finance, not the center; it seems to increase in times of social and political change rather than in quiescent periods; and it tends to be led by entrepreneurial visionaries rather than pushed by the general market. The business and economic context creates challenges and opportunities for financial innovators. Government policies interact significantly with financial innovation, either ex post, in the form of regulations of markets, institutions, and instruments, or ex ante, in the form of incentives or constraints to which innovators respond.

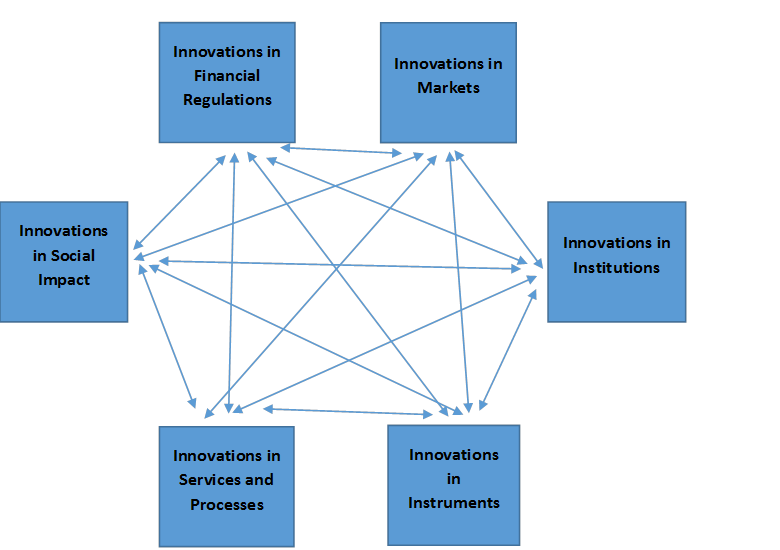

It’s not about seeing, but about looking. Seeing is relatively passive; looking is definitely active. For what should you look? As the course unfolded we explored the ways that innovations in markets, institutions, instruments, processes, social impact, and government regulations worked (or didn’t work.) And we discovered a great connectedness among the parts.

It proved hard to discuss an innovation in instruments without also considering implications elsewhere. To create a new financial instrument has implications for markets where it will trade, for the institutions who will intermediate it, for the processes to service it, for the consequences for society, and for regulation—as we have seen, all of these implications can stimulate financial innovations in those other areas. The biggest implication is that there are no simple stories about financial innovations. You need a wide mental aperture to take in the broad range of possible reactions. Think systemically about feedback effects, dampers and amplifiers of the reactions. Look actively.

Success. How do you know the outcome of a financial innovation was good? High financial return is the superficial answer. We discussed a wide range of indicators such as liquidity, sustainability, customer satisfaction, fulfillment of a social need and reputation. Innovations that help markets function well— through completeness or greater efficiency—can be profoundly beneficial to others. Robert Shiller (and others) have argued that the problems associated with financial innovation are not because of too much, but rather too little, innovation. This implies that the incompleteness of markets (the inability of participants to do what they need) is the dominant problem and opportunity of financial innovation. Success might also reside in prevention of adverse outcomes or even gain prosperity in the presence of adversity—this is the aspiration of Nassim Nicholas Taleb’s concept of “antifragility.” The point is that if you tend to get what you measure, then choosing the measures of success is of paramount importance. At various points in the course, we confronted the possibility of adversities. Easy access to credit markets through “teaser” mortgage rates prompted some borrowers to binge on credit. Income-linked student loans might tempt graduates to spend years on the beach. Structured investment vehicles make it easy for corporations to hide bad assets or too much debt (e.g. Enron). “Dark pool” markets enabled speedy traders to exploit the slow. Generally, complexity in the design of markets, institutions, instruments, and processes impeded the perceptions of investors, credit rating agencies, boards of directors, and regulators. Try to work on chewy problems in a way that can advance, not degrade, the human experience. ((We discussed worthy problems such as wage inequality, pension shortfalls, and volatility in home values.)) All of this brings us around to James Tobin’s remark that the most important decisions one makes are what problems to work on. Financial entrepreneurs face a blizzard of opportune problems. So, work on the worthiest ones.

* * *

This is the end of this path (or maybe the part of your path where I walk alongside). But I hope you feel sufficient momentum to keep walking—or in the sense of Wendell Berry of being led by the ideas and experiences we’ve shared. Be well and prosper.