“A meme (pron.: /_’miːm/; meem) is “an idea, behavior, or style that spreads from person to person within a culture.”A meme acts as a unit for carrying cultural ideas, symbols, or practices that can be transmitted from one mind to another through writing, speech, gestures, rituals, or other imitable phenomena. Supporters of the concept regard memes as cultural analogues to genes in that they self-replicate, mutate, and respond to selective pressures.”

– Wikipedia

As my last couple of posts on the subject of a “market bubble” suggest, I harbor doubts about the justification for the buoyant markets (see this)—and at the same time, I emphasize that the definition of “bubble” is murky (see this); thus, how would we know a bubble when we see it?

I’m in New York today and convened a roundtable discussion of investment management professionals for Darden’s new Center for Asset Management. There, the attendees discounted the notion that the U.S. markets are in the early stage of a bubble. They pointed out that the correlation between GDP growth and the stock market has never been high, that the price/earnings multiples remain at a reasonable level, and that investors are still “under-risked” as indicated by the historically high percentage of assets held in the form of cash. The problem is that the world is awash in liquidity and returns are low because of financial repression by the central banks.

If this is true, then why is the concept of a “market bubble” on anyone’s mind? My guess is that it has been burned into our collective consciousness by recent experience. Mind you, the notion of a “market bubble” has been around since at least 1637 and the bursting of the Tulip Mania, or since 1720, and the collapse of the South Sea Bubble and the Mississippi Bubble. The longer history of bubbles is recounted in Charles Kindleberger’s book, Mania Panics, and Crashes and in Charles Mackay’s book, Extraordinary Popular Delusions and the Madness of Crowds—these are worthy readings for professionals in finance and investing.

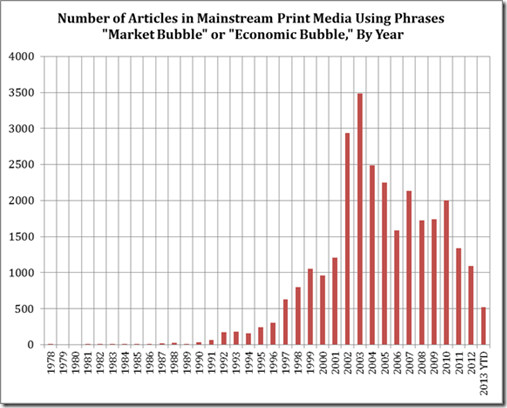

But for much of the post-World War II era, the fear of market bubbles disappeared. Then, at the end of the 20th Century, the “market bubble” re-entered the collective consciousness. The following graph depicts the number of mentions per year of either of two phrases, “market bubble” or “economic bubble” as they appeared in newspapers and periodicals.

These data are drawn from Factiva with the help of Darden’s Reference Librarian, Susan Norrissey.

Note that the volume of references was virtually nil from 1978 to 1991. Then the number rose in the wake of the Tequila Crisis (1994), the Asian Financial Crisis (1997), the Russian Flu (1998), and the dot-com bubble (1997-2000) and its bust (2000). It is not surprising to see the lag between these events and subsequent increases in the number of mentions; as I have discussed in previous posts, it is difficult to make sense of a bubble and writers will continue to try as long as it sells copy. What is remarkable is that the concept of “market bubble” has remained an object of strong interest for so long.

My point is to suggest that “market bubble” is not just a financial concept. It has attained the status of a meme, “a unit for carrying cultural ideas, symbols, or practices…” And the graph suggests that it gained that status well before the Global Financial Crisis. We are a society that carries bubbles in our heads. And for good reason: the cascade of financial crises and panics over the past 20 years has taught us painful lessons.

These are uncertain times for investors. The forthcoming University of Virginia Investing Conference, November 14-15, 2013 at Darden will consider “Finding Opportunity in an Unpredictable World.” See the list of provocative speakers and sessions. Mark your calendar.