The focus of our course this week was the use of financial innovations for promoting desirable social outcomes, such as more savings, more education, better health, safer behavior, cleaner environment, etc. We saw some financial innovations for social impact purposes earlier in the course, such as pandemic bonds, markets for kidneys, and home value insurance. This week we considered social stock exchanges, debt-for-nature swaps, CO2 trading, tradable shares in not-for-profit organizations, and various proposals to promote saving by individuals. It turns out that the point of view we’ve been developing for use in the for-profit economic impact sphere is equally applicable to the social impact sphere.

Much of the attention to social impact starts from a recognition of a social problem and then reasons backward to consider how financial innovation might intervene to alleviate the condition. In the for-profit sphere, one might recognize an incomplete market, a market inefficiency, a barrier to arbitrage, a persistent cognitive bias, a monopoly or other restraint of trade, or an onerous regulation—all of which are market failures in one way or another—and then imagine how a financial innovation might resolve the market failure. In the case of social impact, one might imagine how a financial innovation might help to resolve the social failure.

Many possible solutions. The article by Tufano and Schneider considered ways to promote saving by individuals. It outlined six possible avenues: 1) coercion, 2) opt out policies that make it hard not to save; 3) convenience tactics that make it easier to save; 4) bribes to encourage people to save; 5) leveraging social networks (such as savings circles) to use social influence to encourage people to save; and 6) making saving exciting through devices such as lottery-linked schemes (Wal-Mart just announced a new program whereby you might win money by saving money.) One might generalize from Tufano and Schneider to suggest that any given social failure might be addressed by a number of possible financial innovation remedies.

Income-Linked Loans. The visit by Miguel Palacios and the reading by Robert Shiller illustrate the possible tailoring of debt instruments to meet a social need (such as the desirability of more education for those who cannot afford it). The idea originated with Milton Friedman in his 1962 book, Capitalism and Freedom, in which he asked why individuals cannot find the kind of financing available to corporations (i.e. equity financing, in which investors gain a claim on a part of income). Another precedent is the income bond, in which debt service is contingent on the debtor’s ability to pay.

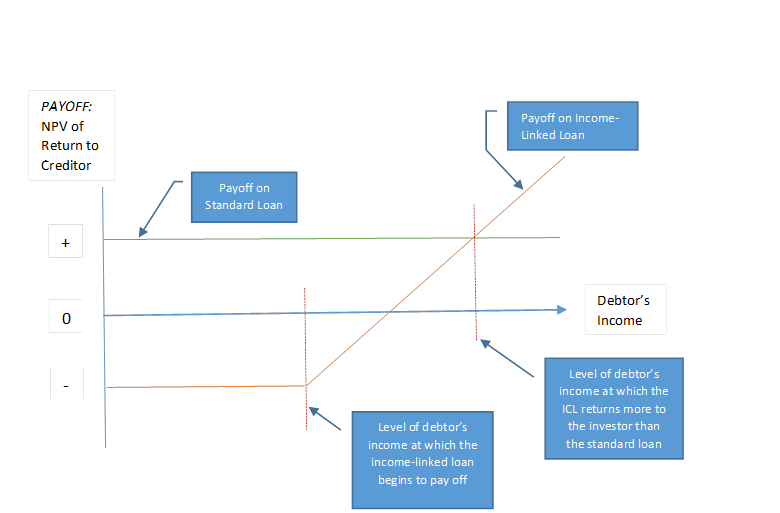

The creation of income-linked loans illustrate an important function of financial innovation, to transform the costs/payoffs in (socially) useful ways. Essentially these proposals amount to converting a fixed-income debt security into a call option. The following diagram represents the Net Present Value payoff (vertical axis) from two types of loans as related to the debtor’s income (horizontal axis):

· Standard loan (green line) entails a fixed interest rate and schedule of principal payments. In theory, the creditor gets paid no matter what, which accounts for the flat line across all levels of income. But in reality, as the debtor’s income approaches zero, the creditor will incur costly expenses for collection services, lawyers’ fees, bankruptcy proceedings, or payoffs to the mafia to get repaid. As a result, the creditor’s payoff will tend to dip downward, the lower the debtor’s income.

· Income-linked loan (orange line) entails interest and principal payments contingent on the income of the borrower. Presumably the terms permit zero debt service if the debtor’s income approaches the poverty level—with zero debt service the creditor’s payoff is negative, equal to the value of the loan. But as the debtor’s income rises, payment to the creditor eventually kicks in, and the payoff line begins to rise. At higher levels of the debtor’s income, the return to the creditor from the income-linked loan exceeds the return from the standard loan.

Why would an investor agree to back income-contingent student loans? If one were purely motivated by profit, it would be rational to invest in the loans if you were confident in your ability to identify the future Bill Gates’s or Mark Zuckerbergs. And option-pricing theory tells us that the option on future income will be more valuable in the presence of greater risk, due perhaps to an uncertain employment environment, uncertain career preferences of the debtor, and uncertain impact of the education on the individual. The transformation from a standard loan to an option transfers risk from one who is less able to bear it to another who can do so. Finally, if one were motivated by social reasons (such as helping poor kids pay for tuition at charter schools or college) then you might be willing to accept the possibility of zero or negative return as a kind of charitable contribution.

We discussed the problem of “optics” with income-linked loans to individuals: they might look like indentured servitude. To this, Robert Shiller replies that in a nation of laws, nothing about an income-linked loan interferes with the individual’s civil rights—indeed, it has the socially-beneficial result of reducing the individual’s risks of hardship and bankruptcy. Another possible criticism is that income-linked loans may be discriminatory: the tendency of lenders may be to search out those students most likely to succeed and thus “cherry-pick” the candidates most attractive in terms of economic return. Needless to say, markets generally tend to discriminate in that fashion. But information problems (such as the inability to identify high-potential candidates in certain segments of society) and biases (such as race, ethnicity, gender, or economic class) warrant careful scrutiny by the social impact investor.

Miguel Palacios offered that the discount rate for determining the NPV an income-linked loan should be negative. He argued that more education tends to increase employability and income levels and provides a safety buffer in the event of layoffs. Such seems to be the case for Darden graduates. You might take some time to ponder how a negative discount rate works and why it might make sense.

Social impact platforms, marketplaces, and exchanges. Markets manufacture information—they afford an arm’s-length assessment of the performance of a participant in the market. A dilemma for many donors to organizations in the social mission and not-for-profit sector entails the assessment of performance. Can marketplace designs help in this respect? Two articles this week offered interesting speculative notions. Robert Shiller imagined the “participation nonprofit” that would sell shares to donors in lieu of charitable contributions. This would give participants a psychological stake in the organization, akin to ownership. Would a marketplace concept help to price the performance of such firms? Could it provide liquidity for disaffected contributors? The article by Sarah Dadush discussed “social stock exchanges.” She highlighted the risk of conflicts of interest between commercial and social aims of participants in these exchanges. To that, one could add other considerations, highlighted in our earlier discussion of innovation in new financial markets—chief among these is volume of activity and/or liquidity. The sustainability of a new market depends entirely on its ability to attract participants.

Environmental finance. The reading by Allen and Yago illustrated how financial innovation might serve environmental conservation and remediation. Environmental degradation arises from negative externalities and the “tragedy of the commons.” The authors discussed three innovations in environmental finance: state revolving bond funds to provide seed money for self-sustaining project financing; debt-for-nature swaps; transferrable fishing quotas; and C02 emissions trading. They wrote,

“The point of departure is the identification of specific market failures that result in environmental degradation. By developing techniques to account for environmental goods and services, innovators can devise market mechanisms and capital market solutions to environmental problems, opening the door to real progress in the quest to conserve air, water, fisheries, wildlife, and biodiversity. The tools already exist to identify and internalize environmental costs, discover prices for environmental goods and services, and finance projects that address environmental needs.” (Italics added) ((Allen and Yago, page 143.))

Limits and risks of social impact finance. To think critically about financial innovations is to look for both the strengths and the weaknesses of any proposal. On the plus side, financial innovations on behalf of social impact help to channel private funds into products and organizations that can alleviate chronic social problems. Questions we raised included these:

1. Are the benefits measurable?

2. Are the organizations and their leaders accountable for performance? What are the protections against corruption and conflicts of interest?

3. Does the benefit depend on greater scale and/or “critical mass?” Many projects, though reasonably financed, start out small and are doomed to fail because of the scope of the problem.

4. Are the benefits and the organizations sustainable?

5. Does it divert money from projects that might otherwise be financed by the private sector?

6. Is it limited to countries where contract law is enforceable?

7. Will it promote “mission drift” by the recipient of the social impact finance?

Insights for the financial innovator. Perhaps the dominant message of our brief exploration is that the tools and techniques observed for financial innovators in the for-profit sector are equally applicable to activities for social impact. Consider that the following points have appeared in previous weeks and appeared this week as well:

1. Find market failures. This was the generic advice stemming from our study of the drivers of financial innovation. Such failures include: market incompleteness stemming particularly from failures of arbitrage; market inefficiencies stemming particularly from information asymmetries; cognitive biases; restraints of trade owing particularly to monopolies, patents, trademarks, and technological expertise; and distortions and unintended consequences arising from regulation. Every market failure presents the seed of opportunity to the financial innovator.

2. Apply existing tools to transform the failure. The example of income-linked loans shows that converting a standard debt to a call option on a person’s income may afford an opportunity to change incentives and promote a desirable outcome.

3. Keep it simple. Plenty of models exist in the for-profit sector that one might adapt for social impact. No need to invent from scratch. Innovate and adapt from existing examples.