Humpty Dumpty said, in rather a scornful tone, “it means just what I choose it to mean—neither more nor less.” “The question is,” said Alice, “whether you can make words mean so many different things.” “The question is,” said Humpty Dumpty, “which is to be master—that’s all.” –Lewis Carroll, Through the Looking Glass

Innovation stretches and even violates commonly-led definitions. This challenges one’s ability to make sense of the evolving landscape. Our focus in classes on October 3rd and 4th was the theme of “Financial Innovations in Institutions.” Right there, we confront Alice’s complaint: how can words mean so many things? For instance, when is a fintech firm a “lender?” Perhaps, as Humpty Dumpty said, the one who defines the terms gains a certain mastery. More on that later.

This post continues my commentary on the middle part of our course, where we look at innovations in markets, institutions, services, instruments, and innovations for social impact. I argued in reviewing the first week that financial innovations tend to be “idiosyncratic,” which means that they tend to span two or more of the five buckets. But thinking about innovations in terms of the buckets helps us approach innovations more rigorously because each of the five buckets contributes important perspectives for thinking critically. For instance, last week, we framed markets as search engines and as manufacturers of information—this framing helped us ask how financial innovations in markets promote search and information manufacture. Here, in week 7, we turned to innovations in financial institutions and encountered some very useful frames for critical thinking.

Institutions manufacture/distribute claims. Financial institutions are intermediaries; they stand in between the supply and demand of capital and help to bring both sides together in mutually profitable deals. An investment bank facilitates an initial public offering (IPO) of a promising young firm by literally buying the shares (financial claims) from that firm and re-selling them at a slight markup to investors. An insurance company writes (manufactures) a fire insurance policy, which is a financial claim on the insurance company’s resources if a fire destroys a home; the insurance company finances this liability from the payments by policyholders. A bank manufactures debt by both borrowing from depositors and lending to borrowers—in doing so, the manufacturing process performs at least four kinds of economic transformations:

1. Maturity. Banks borrow short and lend long. That is, banks finance themselves substantially from retail demand deposits (which could be withdrawn on short notice) and in the repurchase agreement (“repo”) market (overnight funds borrowed from corporations); in turn the banks lend those funds on terms ranging from, say, 90 days up to a 30-year mortgage loan. Banks make money on this maturity transformation because the interest rate they pay on short-term deposits is lower than the interest rate they earn on longer-term loans. The maturity transformation exposes banks to the risk that consumer depositors and repo lenders might suddenly withdraw their funds from the bank in a “run.”

2. Liquidity. Consumer deposits and repo funds are highly liquid, whereas longer-term loans aren’t. Banks get paid for this liquidity transformation because of the risk that consumers and repo depositors will want to withdraw their funds hastily—for this reason, banks must hold reserves to forestall a liquidity crisis.

3. Risk. Banks transform risky assets into relatively less risky deposits. For instance, U.S. Bancorp borrows in the repo market at its high (P-1/A-1) credit rating and probably re-lends to lower-rated customers. Three reasons explain why the riskiness of the bank’s debtors does not translate into the riskiness for depositors:

a. Risk management and reserves. Sound banking practices entail careful scrutiny of borrowers and active management of loan exposures. Also, government regulations require banks to hold reserves as insurance against expected loan losses.

b. Federal deposit insurance gives consumers confidence that their bank deposits are relatively risk-free. Banks pay a fee to the FDIC for this insurance.

c. By avoiding a concentration of its loans in any one company or industry, a bank achieves the benefits of portfolio diversification—this is one of the most important transformations in business. If the returns on the components of a portfolio are less than perfectly correlated, then the risk of the portfolio will be less than the weighted average of the risks of the components. Who benefits from portfolio diversification will be determined by competition: greater competition among banks will tend to drive downward the interest rates they charge. Banks that enjoy a monopoly by virtue of geographic isolation or rare expertise (e.g., financing oil drilling rigs) are likely to charge higher interest rates and deliver higher returns to their shareholders.

4. Basis. Banks typically borrow deposits and repo loans at floating rates of interest and lend at fixed rates—such is true in mortgage lending where banks offer long-term fixed-rate mortgages.

Bear these transformations in mind as you encounter institutions called, “lenders.” Do they all perform the functions of a “bank?” If not, then how do they make money? What risks do they bear? And how do they manufacture and distribute claims? [Hint: Humpty Dumpty again.]

Our readings for this week affirmed the perspective that institutions manufacture and distribute financial claims. Private equity companies purchase the equity and debt in companies that are not publicly-traded and finance those purchases through sales of partnership interests. Kaufman and Englander said that KKR functions as a private “reconstruction finance bank that attempts to create economic value by identifying, purchasing, and restructuring underperforming or undercapitalized (even bankrupt) firms.” (page 53.) By developing a network of limited partnerships with institutional investors and an “investor-controlled governance structure” for its portfolio firms, KKR organized (manufactured) buyouts of companies in private transactions and sold partnership claims on those companies. Kaufman and Englander concluded that KKR’s activities increase output, jobs, and R&D spending.

Geert Rowenhorst’s chapter on “The Origins of Mutual Funds” tells a consistent story. In 1774, Abraham Van Ketwich discerned the desire of small investors in Amsterdam to diversify their investments and founded the first mutual fund, “Unity Creates Strength.” Previously, before the 18th Century, new investment vehicles had created an interest in pooling financial and non-financial assets. Tontines, life annuities, and plantation loans were objects of consumer investment, but were relatively illiquid, fixed, and purchased individually. Van Ketwich “simply repackaged existing securities that were already traded in the Amsterdam market.” (page 259.) The mutual fund concept spread to England, with the founding of the Foreign and Colonial Government Trust in 1868, and then to the U.S. with the founding of the Massachusetts Investors Trust in 1924. Thereafter the appeal of the mutual fund model grew dramatically. In essence, the mutual fund model entails the manufacture of financial claims on a portfolio of securities.

The visit to our class by Doug Lebda, CEO of LendingTree, illuminated the range of new intermediaries. He said that LendingTree is a “marketplace business model…an exchange, which helps buyers and sellers to find each other. You make money making a match.” He contrasted LendingTree from some 300 lenders on the Internet, such as Quicken Loans, Wyndham Capital Mortgage, and EverBank who operate a “retail, cost-plus” lending model and then re-sell the loans to the investors who ultimately own the loan. The online lenders manufacture and distribute financial claims. But the comparison with Lebda’s marketplace business model invites the following question.

What does an institution do that a market or an individual cannot do? In other words, why do institutional intermediaries exist? Our discussions and readings offered several considerations:

· Lower search and transaction costs. Ronald Coase’s famous 1937 article, “The Nature of the Firm,” argued that the reasons firms exist at all is to offer lower transaction costs than individuals face by going directly to the markets. We could add search costs as well. For instance, investment advisers exist to help you sift through the plethora of investment opportunities in the world. Surely some of this cost reduction is due to economies of scale, where the intermediary profits by spreading fixed costs across a large volume of transactions.

· Convenience and security. Bank innovations such as checking accounts, ATMs, and credit/debit cards make it easier to live life without having to lug around a lot of cash. Banks hold valuables in safe deposit boxes and thus grant consumers confidence about the security of their wealth.

· Aggregation of knowledge. Repetitive transactions may result in the accumulation of important information about an industry, a technology, a country, or a class of borrowers. The field of security analysis is founded on the belief that fundamental research into security values is profitable—thus, intermediaries who trade in securities may find it profitable to aggregate knowledge and build expertise. Some borrowers prefer to share private information about their future cash flows and current financial standing with a bank rather than the public capital markets. Banks, private wealth managers, and insurance companies benefit from this preference for privacy and the information asymmetry that results.

· Network effects. In 1913, the Pujo Hearings in the House of Representatives explored whether a Money Trust existed on Wall Street, similar to trusts formed in other industries—the hearings concluded that it did not, though they did find evidence of coordination among banks. Today, such arrangements as private equity “clubs,” underwriting syndicates, and cross-guarantees among firms suggest that relationships among financial institutions may be important resources by which institutions manufacture and distribute claims more efficiently and effectively than markets. The benefits of a network tend to grow as the number of nodes in the network increases.

· Trust and fiduciary power. As I mentioned in my post about Week 5, the number of enforcement actions by various government agencies suggest that markets are not clear of bad actors. It is challenging for individuals to be constantly vigilant (and sophisticated) in looking out for their own welfare. Institutions tend to move faster in response to financial news than do individuals. And under the law, all financial intermediaries are held accountable to principles of fiduciary responsibility. A trust company may manage an estate on behalf of widows and orphans. A mutual fund diversifies stockholdings on behalf of its investors. By delegating investment decisions to an intermediary, an investor gains professional management in place of otherwise slow, emotional, uninformed, and unsophisticated decision-making.

Financial innovators exploit these benefits and displace incumbents. The problem for incumbent institutions today is that the barrier between markets and institutions is growing more and more permeable. Fintech innovators are devising new models for customer service that deliver these benefits without the trappings of traditional institutions. Doug Lebda’s LendingTree is a marketplace: It delivers willing lenders to consumers at lower search and transaction costs. Bond Street does not take deposits, but it makes loans and then syndicates them. Various peer-to-peer platforms bring consumer lenders and borrowers together—in such cases, the platform is the network that the old-line institutions used to service. It is important to recognize that terms in the fintech space are thrown around with abandon, which complicates our efforts to understand the different business models we encounter. For instance, in class we discussed Lending Club, which calls itself a peer-to-peer lender, but which stretches the concept of “peer.” In common parlance, “peer-to-peer” would imply bringing together lenders and borrowers, individuals who have money and others who need money. But Lending Club sources borrowers, arranges with a bank to make the loan, buys the loan from the bank, and then securitizes a portfolio of such loans which it sells to institutional investors. At one end of this daisy chain is a consumer (the borrower) and at the other is a pension fund, insurance company, mutual fund, or some other institution (the lender). It is hard to say that these are peers. Are you listening to Humpty Dumpty yet?

A long-term, ongoing process. The displacement of older, less-innovative financial institutions by newer, more-innovative entrants is one of the enduring themes in the history of finance. In 1987, Robert Aliber wrote what seems eerily applicable to 2016: “Some non-bank financial institutions have increased the range of their activities and so they now offer the consumer nearly all of the services and products that banks do.” (Page 1.) Some of this “creative destruction” is due to a natural life-cycle in business enterprise: Firms start up, grow, mature, and then fade away perhaps because of the death of a founder, the rise of a feckless new generation of managers, or a simple loss of will. In the 1980s, Aliber could look back on tremendous innovation owing to globalization of markets and deregulation. Today, a great deal of innovation seems to stem from changes in technology and demographics (Millennial generation, immigration, retirement of the Baby Boomers, etc.)

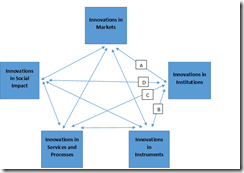

Interdependence among kinds of financial innovation. By now in the course, it seems clear that financial innovations do not occur in a vacuum. They arise from a complex set of drivers. And I have argued that financial innovation is idiosyncratic; innovations tend not to fit neatly into one silo. Aliber illustrates this by recounting that the advent of Merrill Lynch’s Cash Management Account in 1975 (a new instrument) drove disintermediation, which in turn drove liberalization in the banking industry (i.e., changes in products, branching, bank size, and operations). In short, he suggests an interaction between the innovation in markets and in institutions. This reminds us that we should not think strictly in terms of the silos of markets, institutions, instruments, or services, but rather, to look for the influence of all of them on each other—this interdependence is depicted in the following figure.

To focus only on innovations in institutions, consider four interactions we have encountered in this course so far. ‘A’ would be represented by the rise of the Eurodollar bond market, which prompted banks to globalize. ‘B’ is the example of Merrill’s CMA, which prompted banks to offer market yields on checking accounts. ‘C’ is suggested by the rise of securitization and of more rigorous credit evaluation practices in the 1920s, which prompted banks to broaden the availability of credit. And ‘D’ could be remembered as the rise of mortgage loan guarantees (Fannie Mae and Freddie Mac) and community redevelopment programs, which spurred the advent of the originate-and-distribute mortgage lending institutions such as Countrywide.

Questions for innovators in new financial institutions:

1. What is the problem that this new institution solves? Look toward the factors that emerged in our discussions and readings: costs, convenience, security, knowledge, network, and trust. How does the new institution solve this problem better than incumbents? And from what one sees happening in the fintech world, the benchmark of comparison should not only be the incumbent institutions, but rather, the markets. Therefore, how does the new institution solve this problem better than the customer can find directly in the financial markets?

2. What is the new knowledge that this new institution will aggregate, distill, and exploit? Of all the explanations for the existence of financial institutions, the aggregation of knowledge is most compelling because it is hard to do and because it is such a reliable source of competitive advantage in business. New tools from big data, artificial intelligence, machine learning, and advanced analytics are the exciting frontier of institutional innovation through knowledge aggregation.

3. What will be the pattern of disruption of financial institutions? In previous weeks, we discussed drivers of financial innovation. And as the diagram above suggests, a search for institutional disruptors will find useful insights by looking at innovations currently occurring in markets, instruments, services/processes, and social impact.

4. Why now? If, as I argue, drivers and context matter in the success of financial innovations, and if the forces of change and the context continuously change, it will be valuable to consider what is the window of opportunity, and on what that open window depends.

5. What will you call it? Humpty Dumpty alert: the naming of financial innovations probably has something to do with their aspirations. This is clearer now, after our foray into innovation in financial institutions. We see a peer-to-peer lender (Lending Club) who arguably isn’t. We see old-line banks, exchanges and marketplaces (LendingTree), originate-and-distribute firms (Lending Club), and the ultimate investors in the claims that these institutions generate—all are “lenders” in the sense that they help borrowers borrow. But they all have rather different activities and profiles of risk and return. The reason they call themselves “lenders” is that the ultimate consumer, the borrower, doesn’t care: all money is green, whether it comes from one kind of lender or another. Thus, as Alice might say, they all make the word to mean so many things because some of these institutions are entrants and want a place in the market. And as Humpty Dumpty might say, they make a word to mean so many things because of a contest for mastery. Innovation in financial institutions is changing the rules of competition. Thus, the descriptors for these new institutions may presage their ultimate success.