Approaching the end of our course on financial innovation, it is appropriate to review the pluses and minuses of such activity. We deferred this until after our survey of the different kinds of innovations so that our reflection on criticisms and defenses would be more acute. I have combined our reading and discussions across two weeks into one post in order to synthesize some larger insights. How one views financial innovation depends on how one views the pluses and minuses to society—and in particular, the effect of financial innovation on stability of the financial system.

Today, a conversation about the criticisms and defenses of financial innovation is framed by recent experience. The Panic of 2008 has become the dominant reference point for critics and defenders. Therefore, before getting into the pros and cons of financial innovation, it is useful to sketch some highlights about the late unpleasantness.

The Financial Crisis as the Stage for Debate

By year 2000, economists seemed to declare victory over the recurrence of depressions and panics. Olivier Blanchard and John Simon (2001) reported that since the mid-1980s, variability of GDP growth had declined by half and variability of inflation had declined by almost two-thirds. Nobel Laureate Robert Lucas, in his Presidential Address to the American Economic Association in 2003 said,

“macroeconomics in this original sense has succeeded: the central problem of depression prevention has been solved, for all practical purposes, and has in fact been solved for many decades…the potential for welfare gains from better long-run supply-side policies exceeds by far the potential from further improvements in short-run demand management.” ((Lucas (2003) page 1.))

And a study by Nobel Laureate Joseph Stiglitz, Jonathan Orszag and Peter Orszag (2002) found a smaller than 1:500,000 chance that Fannie Mae would fail. And in a speech to the Eastern Economic association in 2004, Federal Reserve Board Governor Ben S. Bernanke attributed “the Great Moderation” to the structural supply-side changes to which Lucas earlier referred, to improved monetary policies, and to good luck.

Then the panic hit, and economists resurrected notions that the capitalist economy was prone to financial instability. Financial innovation was an obvious target. New markets, new technologies, new institutions, and new instruments—many with unpronounceable names and inscrutable justifications—surfaced at the center of institutional insolvencies and bailouts. Investigative journalists reported practices by mortgage loan administrators, bond rating agencies, lenders, traders, and investors that illustrated the propensities toward neglect, deception, corruption, and predation that Minsky and others hypothesized. Nolan McCarty, Keith T. Poole, and Howard Rosenthal (2013) wrote,

“In addition to deregulation, financial innovation was central to the crisis. The problems in the home mortgage market would not have produced a crisis bubble without important changes in how these loans were securitized. The innovations involved the development of three new products: privately issued mortgage-based securities, the tranching of the securities, and the swaps market that insured the securities. But perhaps the most important innovation involved the extent to which these investments were leveraged.” ((McCarty et alia, (2013) page 140.))

The report of the U.S. Financial Crisis Inquiry Commission (2011) highlighted “gaps in oversight of critical areas with trillions of dollars at risk, such as the shadow banking system and over-the-counter derivatives markets.” ((Financial Crisis Inquiry Report (2011) page xviii.)) The Commission was not able to agree on causes and remedies. Six of the ten Commission members were appointees of the Democratic Party, and concluded:

“But underneath, something was going wrong. Like a science fiction movie in which ordinary household objects turn hostile, familiar market mechanisms were being transformed. The time-tested 30-year fixed-rate mortgage, with a 20% down payment, went out of style. There was a burgeoning global demand for residential mortgage-backed securities that offered seemingly solid and secure returns. Investors around the world clamored to purchase securities built on American real estate, seemingly one of the safest bests in the world. Wall Street labored mightily to meet that demand. Bond salesmen earned multimillion-dollar bonuses packaging and selling new kinds of loans, offered by new kinds of lenders, into new kinds of investment products that were deemed safe but possessed complex and hidden risks…”All this financial creativity was a lot like cheap sangria,” said Michael Mayo, a managing director and financial services analyst at Calyon Securities (USA) Inc. “A lot of cheap ingredients repackaged to sell at a premium,” he told the Commission. “It might taste good for a while, but then you get headaches later and you have no idea what’s really inside.” The securitization machine began to guzzle these once-rare mortgage products with their strange-sounding names: Alt-A, subprime, I-O (interest-only), low-doc, no-doc, or ninja (no income, no job, no assets) loans; 2-28s and 3-27s; liar loans; piggyback second mortgages; payment-option or pick-a-pay adjustable rate mortgages. New variants on adjustable-rate mortgages, called “exploding” ARMSs, featured low monthly costs at first, but payments could suddenly double or triple, if borrowers were unable to refinance. Loans with negative amortization would eat away the borrower’s equity. Soon there were a multitude of different kinds of mortgages available on the market, confounding consumers who didn’t examine the fine print, baffling conscientious borrowers who tried to puzzle out their implications, and opening the door for those who wanted in on the action…The instruments grew more and more complex: CDOs were constructed out of CDOs, creating CDOs squared. When firms ran out of real product, they started generating cheaper-to-produce synthetic CDOs—composed not of real mortgage securities but just of bets on other mortgage products. Each new permutation created an opportunity to extract more fees and trading profits. And each new layer brought in more investors wagering on the mortgage market—even well after the market had started to turn. So by the time the process was complete, a mortgage on a home in South Florida might become part of dozens of securities owned by hundreds of investors—or parts of bets being made by hundreds more.” ((Financial Crisis Inquiry Report (2011) pages 6-8.))

Four of the ten members of the Commission were Republicans and wrote dissents to the majority report. One dissenter argued that the crisis was attributable to the creation of government-sponsored entities combined with aggressive lending mandates from the Department of Housing and Urban Development. Three of the dissenters acknowledged that financial innovations played a role in the onset of the crisis, but that the impact of these innovations was dwarfed by a confluence of ten causes. ((The ten causes were credit bubble, housing bubble, nontraditional mortgages, credit ratings and securitization, financial institutions that concentrated correlated risks, leverage and liquidity risk, risk of contagion, common shock, financial shock and panic, and an ensuing economic crisis.)) The dissenters wrote,

“Some focus their criticism on the form of these financial instruments [mortgage-backed securities]. For example, financial instruments called collateralized debt obligations (CDOs) were engineered from different bundled payment streams from mortgage-backed securities. Some argue that the conversion of a bundle of simple mortgages to a mortgage-backed securities, and then to a collateralized debt obligation, was a problem. They argue that complex financial derivatives caused the crisis. We conclude that the details of this engineering are incidental to understanding the essential causes of the crisis. If the system works properly, reconfiguring streams of mortgage payments has little effect. The total amount of risk in a mortgage is unchanged if the pieces are put together in a different way….Rather than “derivatives and CDOs caused the financial crisis,” it is more accurate to say

· Securitizers lowered credit quality standards;

· Mortgage originators took advantage of this to create junk mortgages;

· Credit rating agencies assigned overly optimistic ratings;

· Securities investors and others failed to perform sufficient due diligence;

· International and domestic regulators encouraged arbitrage toward lower capital standards;

· Some investors used these securities to concentrate rather than diversify risk; and

· Others used synthetic CDOs to amplify their housing bets.” ((Financial Crisis Inquiry Report (2011), pages 425-427.))

VIEW CON: Financial innovation is pernicious.

The indictment of financial innovation rests on at least four avenues of criticism: economic productivity, financial stability, culture, and ideology. Consider each of these in turn.

Financial innovation degrades the stability of the financial system. Hyman Minsky (1986) argued that financial innovation contributes to instability of the financial system and thus, to the occurrence of financial crises. The invention of new money was driven by

“…profit-seeking activities by businesses, financial institutions, and households as they manage their affairs. In this process innovation occurs, so that new financial instruments and institutions emerge and old instruments and institutions are used in new ways. These changes, along with legislated and administrative changes that reflected the aura of success of this period, transformed the financial and economic system from one in which a financial crisis was unlikely into one that was vulnerable to crises.” ((Minsky (1986) pages 78-79.))

Ongoing innovations in markets, institutions, and instruments ensure ongoing systemic vulnerability. The solution to cycles triggered by the instability of the financial system, said Minsky, was both increased regulation of the financial sector and very liberal management of the demand side of the economy i.e., through public works programs, full-employment schemes, and so on. Bruner, Carr and Mehedi (2016) examined five major U.S. financial crises to explore the relation between financial innovation and crises. The natural functioning of markets, in which prices adequately reflect the current situation and outlook for the future, was impaired. While financial innovations don’t necessarily cause financial crises, they may well increase the propensity for crisis. Financial innovation seems to promote systemic fragility by:

· Making it easier for participants to access the capital markets and to increase leverage. Securitization enhanced the ability of subprime borrowers to obtain mortgages in the early 2000s. Bank notes made it easier for frontier borrowers to obtain loans in the early 1830s. The introduction of interest-bearing checking accounts attracted consumers to trust companies. HELOCs (home equity lines of credit) made it possible for consumers to obtain loans in the 2000s. Financial innovations made it easier for participants to act on euphoric expectations. Every crises is preceded by a bubble, founded on unsustainable expectations.

· Increasing complexity, which creates information asymmetry. Information problems create risks of adverse selection (i.e., exploitation of the less-well informed by the better informed), amplify the sensitivity to signals about the state of the market, and promote herd-like behavior (where the less-well informed seek to emulate actions by the better-informed.) The account of Bookstaber (2007) suggests that the traders of a major financial institution really did not understand the risks of mortgage-backed securities that the traders were buying in advance of the Panic of 2008.

· Deepening connectedness among participants in the financial markets. In 1837, banks held bank notes issued by other banks. In 2008, large banks linked more broadly to other banks, shadow banks, and corporations through the repo, ABCP, and CDO markets

· Shifting risk in new ways. The extension of credit spread beyond the chartered banking system into the shadow banking system in 1837, 1907, and 2008. In the 2000s, Structured Investment Vehicles shifted risk from the balance sheets of banks to these affiliates.

Financial crises occur a matter of years (in some cases, decades) after the introduction of the financial innovations that were indicted in the crises. Clearly, the introduction of the innovation did not spark the crisis. The long elapsed time allows for any number of factors to create a crisis. Yet, something about the way in which financial innovations disseminated and were used contributed to the crises. For instance, securitization of mortgages began in the 1920s. But it was not until the aggressive engineering of securitized mortgages (with tranching and high leverage) that such securitizations became toxic.

Perhaps financial innovations contribute to the slow-fast occurrence of a crisis: innovations spread gradually, like an epidemic or social fad and then morph as financial entrepreneurs apply increasingly aggressive tactics to increase the returns and other measures of attractiveness. Gradually, these financial products become more complex, customized, and opaque, as Richard Bookstaber has written ((Richard Bookstaber, “Does Financial Innovation Promote Economic Growth?” Blog, November 4, 2009, at http://www.economonitor.com/blog/author/rbookstaber3/.)) —and they become more destabilizing to the financial system. Andrew Palmer described this process:

“In simple terms, finance lacks an “off” button. First, the industry has a habit of experimenting ceaselessly as it seeks to build on existing techniques and products to create new ones (what Robert Merton, an economist, termed the “innovation spiral”). Innovations in finance—unlike, say, a drug that has gone through a rigorous approval process before coming to market—are continually mutating. Second, there is a strong desire to standardize products so that markets can deepen, which often accelerates the rate of adoption beyond the capacity of the back office and the regulators to keep up.” ((Andrew Palmer, “Playing with Fire,” the Economist, February 25, 2012, page 5 at heep://www.economist.com/node/21547999.))

Financial innovation does not strengthen economic productivity, growth, or welfare. Echoing Minsky, Luigi Zingales has written that “There is no theoretical basis for the presumption that financial innovation, by expanding financial opportunities, increases welfare.” ((Zingales (2015) page 9.)) He notes that research by Oliver Hart (1975) and Ronel Elul (1995) challenged the idea that completing markets is always beneficial: Hart found that in the case of incomplete markets (which is likely the reality today) adding another market can worsen welfare. And Elul affirmed Hart’s finding and suggested that the welfare loss is even more pervasive than previously believed. Elsewhere, Zingales explored the darker attributes of financial innovations. He wrote, “I fear that in the financial sector fraud has become a feature and not a bug.” ((Zingales (2015, page 19.)) In 2009, former Fed Chairman, Paul Volcker, said, “The most important financial innovation that I have seen the past 20 years is the automatic teller machine…I have found very little evidence that vast amounts of innovation in financial markets in recent years has had a visible effect on the productivity of the economy.” ((Paul Volcker, quoted in New York Post, December 13, 2009, accessed at http://nypost.com/2009/12/13/the-only-thing-useful-banks-have-invented-in-20-years-is-the-atm/.)) Paul Krugman added, “it’s hard to think of any major recent financial innovations that actually aided society, as opposed to being new, improved ways to blow bubbles, evade regulations and implement de facto Ponzi schemes.” ((Krugman (2009).))

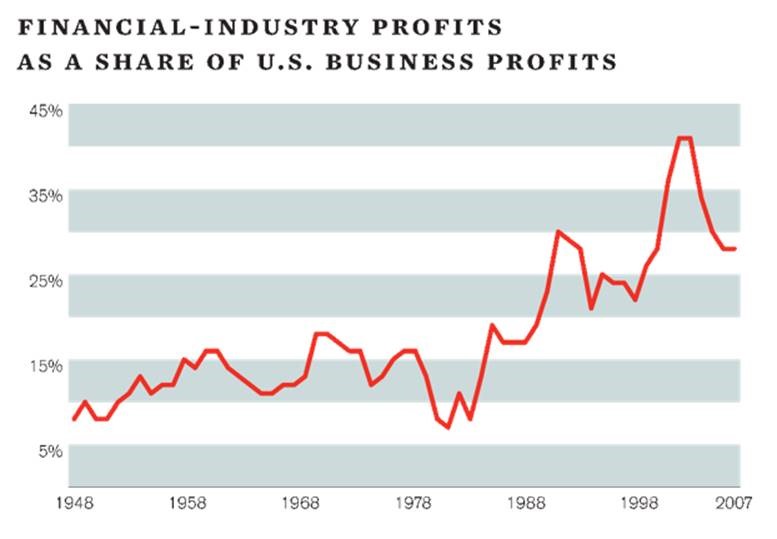

Financial innovation distorts culture. The article by Per Hansen argued that the Panic of 2008 was a tipping point for reaction against financialization and that financial innovation was the bandwagon by which financial ideas and norms came to dominate society. “Financialization” refers to the perceived reduction of social values into financial transactions and values—for instance, care for the poor and elderly is reduced to social relief payments; increased social inclusion is reduced to democratization of credit and increased financial access; risk-sharing is reduced to insurance. Financialization results in the increasing intrusion of financial markets, institutions, and products into the real economy and into daily life. Critics point to the growth of the financial sector (in terms of percent of GDP and employment): in 1870, the total economic cost of financial intermediation was less than 2% of GDP to 5% in 1980 to almost 9% in 2010. ((Source: Thomas Philippon, Rethinking the Financial Crisis. See summary at https://tcf.org/content/commentary/graph-how-the-financial-sector-consumed-americas-economic-growth/ .)) And financial industry profits as a share of business profits have grown over the last three decades (the following figure is from James Kwak.) ((See https://baselinescenario.com/2012/02/29/why-is-finance-so-big/))

The critics of financialization assert that it distorts democratic politics (through campaign finance and regulatory capture), misallocates human talent away from productive uses in the real economy, promotes economic inequality, and increases the use of leverage and risk-taking. Securitization, derivatives, shadow banking, private equity and other manifestations of financial innovation are lightning-rods for critics.

Reading into the critics of financialization one finds strong ideological currents, such as populism, communitarianism, egalitarianism, and a profound distrust of finance. Common to many of these is an appeal to fairness and equity. Such sentiments represent common ground for social protest movements such as Occupy Wall Street and the Tea Party. Per Hansen points to an asymmetry of outcomes from financialization: “profits are privatized while the costs of the financial crisis have been socialized.” Because of the asymmetry, government intervention in markets is warranted. And predation figures importantly in movies such as “Wolf of Wall Street” and in the infamous article by Matt Taibbi which characterized Goldman Sachs as a “vampire squid wrapped around the face of humanity.” And the movie, “The Big Short,” conveys incompetence, inattention, a lack of fiduciary duty, and perhaps self-dealing among investment managers leading up to the Panic of 2008. All of this fed the anger with financialization and financial innovation.

VIEW PRO: Financial innovation is largely benign.

Financial innovation is a systemic stabilizer. Neoclassical economists hold that economies are self-correcting and will tend toward equilibrium and that instability is due not to the internal structure of the economy or to innovation, but to shocks from outside (e.g., wars, natural disasters, poor harvests, etc.) Market participants are assumed to be rational; and markets are assumed to be efficient. There is a role for government in stabilizing economic cycles, but not for deep and longstanding intervention.

From this perspective financial innovation seems largely benign: new markets, new institutions, and new instruments arise to complete the markets, match investment returns to consumption needs over time, provide diversification for portfolios, shift risk, reduce transaction costs, increase liquidity, reduce agency costs among different parties, or adapt to changes in technology and other environmental conditions. Among these environmental conditions could be taxes and regulation: Merton Miller suggested that financial entrepreneurs innovate in an effort to arbitrage (or avoid) such constraints. To advance innovation, government should eliminate policies that discourage investment and innovation, tax schemes that produced legal but arduous tax-avoidance behavior, rigidities in the labor market, and generally a suppression of risk-taking. Along these lines, Peter Wallison, a member of the Financial Crisis Inquiry Commission contended that structural impediments to healthy market function, many of them imposed by government, had caused the Panic of 2008.

In the midst of strong civic reaction to the Panic of 2008, Robert Shiller, Nicholas Barberis, and Michael Haliassos (2013) contended that the problem was not too much financial innovation, but too little. Investors did not have the markets, institutions, and instruments by which they could hedge the risk of a collapse of housing prices. The constraints imposed by political and regulatory scrutiny might be averse to the prevention and/or recovery from financial crises. For instance, Robert Shiller wrote,

“I want to emphasize that the best process in fixing the economy after this crisis, or after any crisis, consists of moving ahead by all forms of new invention, including financial invention. Financial crises are often tied up with the uncertainties associated with the recent application of some financial innovation. The process of innovation creates the potential for accidents. But the response to accidents shouldn’t be to reverse the innovation. The response should be moving the economy ahead to be even better, not to patch holes in an existing theory.” ((Haliassos, (2013) page 4.))

This echoed the view of Franklin Allen and Glenn Yago that, “True innovation in capital markets and finance has made access to credit and the ability to build equity more flexible and less costly. …We believe that financial innovations are the cure for instability, not the cause.” ((Allen and Yago (2010) page 21.))

Financial innovation promotes growth, productivity, and welfare. Many economists hold that a well-functioning financial system is essential for a nation’s economic development and that an aspect of “well-functioning” is financial innovation. Joseph Stiglitz wrote, “over the long sweep of history, financial innovation has been important in promoting growth.” ((Stiglitz (2010).)) There seems to be a tradeoff between the costs of financial innovation (systemic fragility, market volatility) and its benefits (faster growth). Thorsten Beck et alia (2012) studied the investment in financial innovation across 32 countries and 21 years and confirmed the tradeoff: more investment in financial innovation was associated with faster GDP growth per capita; but countries with more innovation experienced more volatility and systemic fragility. The authors wrote, “Our findings show that financial innovation provides significant benefits for the real economy but also contains risks that have to be managed carefully.” ((Beck et alia (2012) page 3.))

Financial innovation strengthens society and culture. The ideology of many financial innovators is founded on values of freedom, accountability for one’s own actions, and the virtue of increased connectivity with markets and with other individuals. Innovation brings lower costs, higher quality, greater convenience, more transparency—all of which improve life. Sensible risk-taking is desirable as a stimulus for innovation. Promoting investment in housing and financial securities by all social classes helps to create an “ownership society” that gives a stake for everyone in the performance of the private sector. And an ownership society justifies a focus on shareholder value as a measure of the performance of an enterprise. Improved efficiency is desirable and private markets achieve higher efficiency better than the public sector. For that reason, deregulation, privatization, and tax cuts are warranted. Failure happens, but is not terminal. Markets manufacture important information that helps people make better decisions. Integration among markets (for instance, through lower tariffs) and greater engagement of individuals in those markets promotes a higher quality of life. No economic measure adequately captures the benefits of increased quality and convenience, entertainment, and connectivity. The defenses of financial innovation are roughly associated with the ideology of neoliberalism and laissez-faire.

Conclusions

Our purpose in the course over these two weeks was not to drive an outcome in favor of either the critics or the defenses, but rather to build a familiarity with the key lines of argument. As a practical matter, it seems unlikely that public policy will be gravitate entirely into one camp or the other. Anyway, we will spend the class meetings in Week 13 discussing the regulatory implications of financial innovation. Therefore, the story is not yet complete. But the association of financial innovations with financial instability raises some final considerations.

Through history, financial crises show some association with financial innovations. We have seen this before. This historical association is perhaps the main novelty of this essay and sustains other insights about crises, innovations and civic reaction. But association cannot confirm causation: in the major financial crises in history, financial innovation figured prominently; but not every financial innovation in history is associated with a financial crisis. It might be more appropriate to say that financial innovation is an instrument of larger causes of financial crises.

What seems to threaten financial stability is the convergence of financial innovations with episodes of high growth. In the most buoyant times, innovations will be used more aggressively. And in those times, the infrastructure on which financial stability depends—the technological, managerial, and regulatory spine of financial institutions and the financial sector—fails to keep up with the more aggressive application of the innovations.

Financial innovations associate with financial crises in at least four important ways:

· Make it easier for market participants to act on their euphoric expectations. Every crisis is preceded by a boom or bubble, founded on unsustainable expectations (e.g., “housing prices can only rise.”)

· Make it easier to get money. Many financial innovations create new money or enhance access to money. This can lead to increased leverage and bubble-like pricing of assets.

· Make it hard to know what is going on. Innovations bring complexity. Complexity increases opacity. The result is that some market players know more about the real state of the markets than do others. This information asymmetry fuels panic psychology.

· Deepen connectedness among participants in the financial system. As a result, instability in one part of the financial system can travel to other parts, despite shock-absorbers and regulatory fire-walls.

If financial innovation contributes to financial crises, how can we anticipate the origination of destabilizing innovations? The answer must entail actually looking for them, and in less-obvious places. Innovation occurs at the frontiers, not at the centers of the business economy. Frontiers matter for the understanding of the processes and substance of innovation.

· Demand: The frontiers are where one finds the unmet needs. Organizations at the center of the business economy focus intensively on efficiency, which tends to produce standardization of products and services. And the center tends to deepen its investment in incumbent technology, which produces a disbelief in the need for new products and services. The segments of world population that are “unbanked” and therefore cannot gain access to financial services is huge in absolute terms. New systems of micro finance and electronic payments are being developed to serve this need.

· Supply: And the frontiers are where one tends to find the outsiders–the entrants–who bring a fresh point of view. The centers of the business economy are dominated by incumbents, whose conventional thinking summon products and services that serve a predictable demand. Mind you, incumbents also invest in innovation, but the transformational innovations seem to emerge from entrants at the frontiers, not the center, of business economics.

Works Referenced

Allen, F. & Gale, D. (2000). Financial contagion. Journal of Political Economy, 108(1), 1–33.

Allen, F. & Gale, D. (1991) Financial Innovation and Risk Sharing, Cambridge: MIT Press.

Allen, F, and Yago, G. (2010) Financing the Future: Market-Based Innovations for Growth, Upper Saddle River, NJ: Wharton School Publishing.

Beck, T., Chen, T., Lin, C., Song, F. (2012) “Financial Innovation: the Bright and Dark Sides,” VOX CEPR’s Policy portal, at http:/ voxeu.org/article/financial-innovation-good-and-bad.

Blanchard, Olivier, and John Simon (2001) “The Long and Large Decline in U.S. Output Volatility,” Brookings Papers on Economic Activity, Vol. 1, pages 165-173.

Bookstaber, R. (2007). A demon of our own design: Markets, hedge funds, and the perils of financial innovation. Wiley.

Bookstaber, R. (2009). “Does Financial Innovation Promote Economic Growth?” Blog, November 4, 2009, at http://www.economonitor.com/blog/author/rbookstaber3/

Bruner, Robert F., Sean D. Carr, and Asif Mehedi, (2016), “Financial Innovation and the Consequencies of Complexity: Insights from Major U.S. Banking Crises,” in Complexity and Crisis in the Financial System: Critical Perspectives on American and British Banking, edited by Matthew Hollow, Folarin Akinbami, and Ranald Michie, London: Edward Elgar Publishing.

Elul, R., (1995), “Welfare Effects of Financial Innovation in Incomplete Markets with Several Consumption Goods,” Journal of Economic Theory, 65, 43-78.

The Financial Crisis Inquiry Report: Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States, (2011) New York: Perseus Books.

Haliassos, M. (ed.) (2013). Financial Innovation: Too Much or Too Little? Cambridge: MIT Press.

Hanson, Per, (2014), “From finance capitalism to financialization: A cultural and narrative perspective on 150 years of financial history,” Business History Conference, pages 605-642.

Hart, O. (1975), “On the Optimality of Equilibrium When the Market Structure is Incomplete,” Journal of Economic Theory, 11, 418-443.

Krugman, P., (2009), “Money for Nothing,” New York Times, April 26, 2009, http://mobile.nytimes.com/2009/04/27/opinion/27kurgman.html?

Lucas, R. E. (2003) “Macroeconomic Priorities,” The American Economic Review, Vol. 93, No. 1. (Mar.), pp. 1-14.

Marshall, Alfred (1890), Principles of Economics, New York: Macmillan & Co. (1938 edition).

McCarty, Nolan, Keith T. Poole, and Howard Rosenthal, 2013, Political Bubbles: Financial Crises and the Failure of American Democracy, Princeton: Princeton University Press.

Minsky, Hyman, (1986), Stabilizing an Unstable Economy, New York: McGraw-Hill.

Palmer, A. (2012) “Playing with Fire,” the Economist, February 25, 2012, page 5 at heep://www.economist.com/node/21547999.

Shiller, R. (2012). Finance and the Good Society, Princeton: Princeton University Press.

Shiller, R. (2000). Irrational Exuberance, Princeton: Princeton University Press.

Stiglitz, J. (2010), “Financial Innovation: Against the Motion that Financial Innovation Boosts Economic Growth,” The Economist, February 23-March 3, http://www.economist.com/debate/days/view/471.

Wallison, P. (2011), “Dissenting Statement to the Financial Crisis Inquiry Report” in Financial Crisis Inquiry Report, New York: Perseus Books.

Wicker, E. (2006). Banking Panics of the Gilded Age. Cambridge University Press.

Zingales, L. (2015), “Does Finance Benefit Society?” Journal of Finance, Vol. 70, Issue 4, pages 1327-1363..