“The Olympics is really my favorite sporting event. Although I think I have a problem with that silver medal. Because when you think about it, you win the gold – you feel good; you win the bronze – you think, ‘Well, at least I got something.’ But when you win that silver it’s like, ‘Congratulations, you almost won. Of all the losers you came in first of that group. You’re the number one loser. No one lost ahead of you!’”

— Jerry Seinfeld, from I’m Telling You for the Last Time (1998)

The 2014 Winter Olympics games are now behind us. The cascade of newly-created celebrities sparks a reflection about the winner-take-all phenomenon: the asymmetry of rewards, where the winner reaps an outsized share of the rewards in the game, leaving little or nothing behind for the others. This seems unfair, especially on behalf of those who trained thoroughly, played hard, observed the rules, and finished second…or last. And it is not hard to find examples. Olympic Gold Medalists benefit disproportionately from endorsement revenues, speaking fees, and the like. Think of the compensation of top performing artists, sports figures, and CEOs. Or, think of the windfalls to successful inventors, entrepreneurs, and Nobel Laureates. Think of Secretariat, ranked as the top race horse of the 20th Century—can you recall the also-rans? Think of the sheer dominance of Microsoft in computer operating systems, of Google in Internet search, or of New York and LA in respect to arts and entertainment.

When winners take all

Robert Frank and Philip Cook, in their classic book, The Winner-Take-All Society, wrote that the “winner-take-all markets translate small differences in performance into large differences in reward.” They identified a range of attributes:

- A focus on relative, rather than absolute, performance. In most markets, the reward from your effort is based on how many hours worked or how many widgets produced—those are examples of absolute performance. But in some settings, absolute performance does not yield the reward; what matters is being better than competitors. The focus on relative performance differentiates the winner from the rest. The asymmetry of rewards to effort can lead to the dystopian frame of mind expressed by Gore Vidal: “It is not enough merely to win; others must lose.”

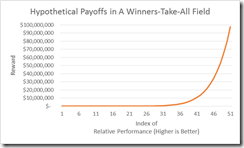

- Concentration of rewards “in the hands of a few top performers, with small differences in talent or effort often giving rise to enormous differences in incomes,” as Frank and Cook wrote (p. 24). To help you visualize what this looks like, the graph nearby presents a hypothetical payoff across a range of 50 players on the basis of relative performance. Math geeks will recognize this as an exponential curve—the point is that the rewards are not flat across performance (pure equality) nor growing linearly (in common proportion across added units of performance). Rather the payoffs compound as units of relative performance grow.

- Overcrowding. For every rock star, there are many thousands of “wannabees.” The focus on relative performance and resulting asymmetric payoffs tend to draw into the competitive field more contestants than may be warranted on any rational calculation of benefits and the probability of winning. Overcrowding causes the dilution of benefits to non-winners across a wider population. All of this leads to “tragedy of the commons” in that too many also-rans depress the per-capita compensation for them. Frank and Cook wrote, “the overcrowding problem in winner-take-all markets arises because participation in these markets is misleadingly attractive to individuals.” (p.21) They point to a variety of possible causes of overcrowding, such as overconfidence (a belief that you can beat the odds and win); thrill-seeking; status-seeking, and/or intrinsic joy in the activity (you love to sing opera in the shower and therefore audition for the Met).

- The rise of mass-markets for some kinds of talent (e.g. prizefighting on cable TV) that makes it possible to reach a very large audience and leads to outsized purses to the winner.

- Network effects can create winners who take all: consider that a product can become more valuable, the more people that use it. The fax machine is a prime example, as is Microsoft’s Windows software. Competitors in a market may be able to gain outsized rewards through the adroit use of network effects.

- Lock-in or barriers to exit—path dependency. Microsoft Windows illustrates another aspect of winner-take-all markets: apparent customer loyalty might be driven by the cost and inconvenience of switching to a competitor. The customer is locked-in, assuring repeat sales and a strong market franchise. This produces what Frank and Cook call, the “Matthew Effect” (“For unto everyone that hat shall be given, and he shall have abundance; but from him that hath not shall be taken away even that which he hath.”)

- Feedback loops. Being known as a leader may enhance your chances of remaining a leader in future rounds of competition. Think of the movie director who gets bankrolled on the basis of past film successes, or the Grand Slam tennis pro who gets top-seeding in subsequent tournaments. In business, the saying was, “you never get fired by buying IBM”—where you are less confidence in your own analysis, it may be easier to go with a well-known brand. Well-branded products can discourage buyers’ remorse. Of course, the feedback loops can work in a negative direction as well.

- The emergence of “deep-pockets markets,” which Frank and Cook describe as “a small number of buyers intensely interested in the winner’s performance.” The market for expensive art, yachts, and professional services such as law, asset management, or investment banking. Customers in these markets want the very best and are relatively price-insensitive.

- Markets for status or positional goods. The economist, Thorsten Veblen, first identified “conspicuous consumption” as a phenomenon in economic behavior. Perhaps people buy luxury goods not because they are better made, but because they signal success, exclusivity, and taste and therefore help to attain higher social status. Such goods are all about relative positioning and they command a substantial premium in the market.

- Information revolution. We are flooded with free and easily accessible information that helps us make relative comparisons, such as “likes,” ratings, rankings, and customer comments. More is known about products and their relative positions. There is more criticism, commentary, and opinion-generation. Aggregators of opinion (Fandango average the ratings of critics and fans). Information overload makes one default to the positionally-dominant product—branding pays. IT grants an increased ability to match products and buyers in deep-pocketed markets (e.g. ebay). Increased transparency about social context heightens relative comparisons: think of the close scrutiny drawn by published salaries. The advent of information technology has undoubtedly intensified the winner-take-all phenomenon through transparency that helps one to compare relative positions.

The problems with winner-take-all markets, as Frank and Cook see it, have to do with wasteful investment, overwork to try to stay competitive with peers, or over allocation of talent to a field of marginal benefit to society (how many oboists or hedge fund traders does the world need?) In an effort to cultivate the aura of a “winner” contestants may tend to overinvest in cosmetics, clothes, homes, and lifestyles. Wasteful investment might lead to intensified competition in settings where collaborative effort might be better—the aspirants to the top job in politics or business might behave in ways that make the enterprise or society worse off. This is the familiar “prisoner’s dilemma” problem in which individual incentives yield bad results for the group as a whole.

Now, take a deep breath

It is the notion that the rewards accelerate (“the rich get richer”) that makes the winner-take-all phenomenon a piñata for egalitarians. The fact that the rich get richer—without much more absolute performance—seems unfair. Does the fact that the Gold Medalist beat the Silver by a tenth of a second warrant a much richer payoff for the Gold? Going farther down that path, one might wonder how much of a time difference would justify a greater payoff for the Gold? That’s like asking how much curvature in the payoff graph you would be willing to accept. The fact that people will disagree on the answer makes it very difficult to assert exactly when a market becomes winner-take-all. We are left echoing the words of former Supreme Court Justice Potter Stewart, who opined in reference to obscenity, “I know it when I see it.”

America values equality of opportunity. But strict equality often imposes its own tyranny. And life is full of unfair advantages. You might envy your neighbor’s good looks—do you really feel that society owes you a surgical makeover? Anyway, is the downside of failure in a winner-take-all market always catastrophic? In his seminal article on winner(s)-take-all (“The Economics of Superstars”), Sherwin Rosen wrote,

Too little is made of the option value of occupational risk-taking. Private and social losses are limited by a person’s option to quite competing and try something else. Working life and long and most of the time this information comes fairly quickly. There is compelling empirical evidence…that lawyers who do not make partner in big firms live nicely as partners in smaller ones, that would-be Picassos live useful and rewarding lives as commercial artists, and similarly for just about every high risk occupation. Some people who fail do suffer disastrous consequences, but generally less is at stake in these gambles than meets the eye. (p. 135)

It is argued that winner-take-all markets reveal an inefficiency, a market breakdown. Flawed markets invite government intervention, which Frank and Cook sought to remedy by progressive taxation, “arms-limitation” agreements, and other intrusions. But there is not enough evidence yet to convince an objective judge that this market inefficiency is so costly as to warrant intervention. Anyway, it is hard to imagine what might be the interventions in higher education. Is the NCAA a good model of “arms limitation” in higher education? Is it really all that bad? In reviewing the book by Frank and Cook, John Kenneth Galbraith (himself an opponent of economic inequality) wrote,

The problem is that a good point is carried to extremes—generalized well beyond its reach. This is not a winner-take-all society; rather, it is an economic world in which the case the authors describe plays an interesting but far from dominant role. No wheat grower, no dentist, no housepainter has a dominant position in his or her industry. Athletics, which is the authors’ starting point and to which, rather significantly, they frequently return, is programmed to produce a clear-cut winner; not so for many other activities, even where there is considerable market concentration. I recently looked into the matter of automobile excellence. I came away from the search almost completely innocent as to which might be the best—or the best for me. The fact that so many companies—U.S., Japanese, German, Swedish—all compete and survive goes far to refute the idea that there is any clear winner in automobiles, that there is any serious chance that one will soon take most, let alone all.

As business ethicists usefully remind us, the really chewy dilemmas don’t involve choices between good and evil, but between two goods. In the case of the winner(s)-take-all phenomenon, we see our values of fairness (or social good) pitted against merit (or individual good.) It is argued that the winner(s)-take-all markets divert rewards to the apparent winners on the basis of attributes other than merit and function to the detriment of the also-rans. Here, we confront the definition of “merit” and “detriment” and how they are measured. Again, we are stuck in Potter Stewart-land.

So what?

You can debate the impact of the winner(s)-take-all phenomenon, but I would advise you not to deny its existence or relevance. Business students are making career choices this season. And it looks like the secondary market for talent (judged by headhunter activity) is heating up. Several different entrepreneurs have whispered to me that they are about to launch new businesses. In these and other contexts, relative positioning can matter a lot—and this means that you face potential asymmetric payoffs characteristic of winner(s)-take-all. Such markets are clearly not for the faint-of-heart: the failure rate is very high; the field will likely be crowded; competitors probably overinvest beyond rational bounds; competition may grow intense and even unethical; and ultimately the difference between the winners and the rest may be scant.

I’ll have more to say about the winner(s)-take-all phenomenon in future posts. But here are a few generic questions to consider as you peer into the unknown right now:

- In the place to which I’m headed, how important in their evaluation will be will be relative performance versus absolute performance?

- On what basis is performance assessed?

- In producing such performance, how significant are effects such as reputation/branding, lock-in, status, mass-markets, and deep pockets?

- How crowded is the field of competition?

- How have the rewards been distributed in the past? How asymmetric is that distribution?

- How much transparency is there regarding the distribution of rewards?

- And the really big one: How much time, talent, and treasure am I willing to invest in an effort to win?

Jerry Seinfeld’s riff on the Olympics is funny on one level. But as psychologists tell us, there is often a kernel of anger within humor. No doubt, Adam Nelson knows. Nelson (Darden MBA 2008) won the Silver Medal in the 2004 Olympics, in the shot put event. Then, in May 2013, the International Olympic Committee awarded the 2004 Gold Medal to Nelson when it was revealed that the apparent previous winner was guilty of drug doping. The Associated Press quoted Nelson a year ago: “It’s not just a victory for me, but a victory for the system. I can’t dwell on what happened or didn’t happen eight years ago. I can only look forward to what the next phase in life brings. At least now I can do that with a Gold Medal.” Or, as Seinfeld said, “you win the gold, you feel good.”