In April, the Global Water Initiative held a panel discussion at Darden on impact investing in water, a relatively new phenomenon. As a follow-up to the panel discussion, we had a conversation with Andrea Barrios (Darden MBA 2016) from The Rockefeller Foundation. Andrea Barrios participated in the panel and specializes in innovative finance projects at the Foundation[1].

What is impact investment? And how, if at all, is impact investment in water different from other types of impact investment?

About ten years ago, the term “impact investing” was coined at a meeting hosted by The Rockefeller Foundation, putting a name to investments made with the intention of generating both financial return and social and/or environmental impact. The Foundation spent the next several years building the necessary infrastructure to accelerate the global growth of impact investing. What was once a nascent field has grown quickly and is attracting a variety of investors, both retail and institutional. As new actors enter the field with new impact products, the question that keeps coming up is, what counts as impact? It depends. Omidyar [Network, a philanthropic investment firm] released a “returns continuum” framework, a useful tool to evaluate the impact/financial returns across a variety of different instruments. Additionally, three years ago, the UN introduced the Sustainable Development Goals, which have given the industry a common language and a starting point for talking about impact, including water.

Water is essential to life and is something we can all agree on, regardless of political or religious views. Water issues touch both developed and developing economies. It’s also personal and very tangible. We can feel when it is scarce and when it’s too much. It’s hard to isolate water into a single category because it is present across so many issue areas, but the impact opportunities are boundless at both the social and environmental levels.

What is the promise of this category of investments, and what are the challenges?

Global philanthropic funds, even when combined with the development or aid budgets of many governments, add up into the mere billions of dollars. Meanwhile, the cost of solving the world’s problems runs into the trillions—including an estimated $2.5 trillion annual funding gap needed to achieve the Sustainable Development Goals in developing countries alone. Yet more than $200 trillion in assets are currently held by institutional, household, and retail investors. Mobilization of private capital is urgently needed to fill this gap and address pressing global challenges. Impact investing is the first step, but we need to think about market solutions and creating vehicles for the assets sitting on the sidelines to flow through.

Today, The Rockefeller Foundation’s innovative finance portfolio, Zero Gap, works to close this gap by developing new innovative financing mechanisms—such as products, partnerships, and processes—to mobilize large pools of private capital by identifying and supporting innovations that have the potential to create outsized impact. Innovative finance is about an expansive set of solutions to channel even more resources in new and better ways to solve our most entrenched problems. Innovative finance looks at tools such as insurance or new debt capital market solutions, as well as more traditional impact investing solutions.

For example, green bonds, an asset class that is over a decade old, represent both the tremendous opportunity and challenge in the space. Green bonds are fixed income securities that raise capital for projects with environmental benefits such as renewable energy, low carbon buildings and energy efficiency, clean transport, sustainable waste management, and many other “green” projects. There is no regulation and green bonds are largely self-labeled: the Climate Bonds Initiative and Green Bond Standards provide an outline as what constitutes green project. However, we still see various shades of green and accusations of greenwashing. Regardless, the green bond market is booming: last year saw a total green bond issuance of over $150 billion and in 2018 it is expected to hit $200 billion. A new subset of green bonds are blue bonds, which specifically relate to water-related activities. With the diversification of issuers and innovation around projects, complemented with improvements in technology to monitor and report, we are starting to see a regulatory push to develop green labeling. Last year, the European Investment Bank, the first green bond issuer, coauthored a report calling for green labelling. If the perception of the green bond premium is correct, investors will expect issuers to deliver on environmental benefits.

How important is it that impact investments yield a comparable return (not a discount) compared to other investments?

It is false to classify “impact investing” as a single asset class, which is what I believe tends to happen. There is a variety of classes across a spectrum of different risk/return profiles and levels of impact. It is incorrect to assume that all forms of impact investing come from concessional (discount) returns. Business leaders and investors are increasingly recognizing that they have an important role to play in addressing our global challenges, not just for reasons of charity or goodwill, but also to manage risks and protect their future markets. Blackrock CEO Larry Fink’s letter to shareholders solidifies this message: “to prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.” With the rise of passive investment, and because of both their strategy and scale, large index providers such as BlackRock don’t pick individual winners, but rather own entire industries. As a result, passive investors have an interest in the long-term health of entire industries and hold unique leverage to influence the behavior of whole industries due to their equity holdings. An example is when Vanguard urged companies to disclose how climate change could affect their business and asset valuations and voted against Exxon Mobil management – now is required to report on climate.

Similarly, individuals are increasingly demanding investment products, opportunities, and approaches to their personal finance that allow for simultaneous financial, social, and environmental returns as highlighted by the explosion of impact investing, which continues on a massive growth trajectory..

ImpactAlpha, the industry newsletter, has an entire section dedicated to following the deal flow and continues to add many more across the spectrum every week. We are at the tipping point in the world of impact investing and innovative finance. Last year we saw the entrance of heavy weights, TPG Rise (which hit its $2bn target) and Bain Double Impact and we will continue to see more products and educated investors/managers demanding them. In the past ten years, the industry has matured from social enterprises to market driven solutions. It’s a start, but the challenge remains of how to channel more of this capital, at scale, to fund critical development needs.

What are the types of innovative finance projects that you at The Rockefeller Foundation are involved in?

Through our Zero Gap portfolio we support a diverse array of structures, regions, and issue areas that are designed to generate market returns while addressing social and environmental needs. As a philanthropic institution, we are in a unique position to take on risks and make catalytic investments to launch pilot transactions that traditional market players can’t do. Working at the intersection of finance and international development, we are committed to leading the charge, as we did for the field of impact investing, to develop the next generation of finance models, processes, and platforms.

Some examples of investment in water from our portfolio:

- Forest resilience bond: a pay-for-performance mechanism for private investors to invest in forest restoration that prevents wildfires and increases water outputs in drought-prone areas in California. By accelerating the flow of capital to scale forest preservation work, private investors can contribute to making forests healthier and more resilient while receiving market rate returns on their investments. A forest resilience bond will be a compelling investment opportunity given its competitive risk-adjusted returns, potential for portfolio diversification, and social and environmental impact.

- Environmental impact bond: a pay-for-performance municipal bond to finance green and resilient infrastructure. It gives local governments room to experiment with ways of protecting their residents against the impacts of climate change by providing a sort of insurance policy against failure of the projects. For investors, there’s an upside, too: if the project works better than expected, they get a bonus payment.

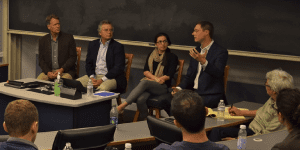

Brian Richter (Sustainable Waters), Disque Dean (Water Asset Management), Andrea Barrios (Rockefeller Foundation, MBA ’16) and Kevin Schuyler (Cornerstone, MBA ’97) at panel discussion on impact investing in water at Darden. - Blue bond: While not in our portfolio, this is an excellent example of an innovative blended-capital solution. For example, the Republic of Seychelles will issue a blue bond and use its proceeds to improve the conservation of marine resources and further development of their blue economy. There is significant potential to influence how ocean-based development can take place in the future and raise awareness around blue economy themes. Blue bonds can create a model for funding fishery recovery efforts for other small island developing states and coastal countries.

[1] This publication has been prepared solely for informational purposes, and has been prepared in good faith on the basis of information available at the date of publication without any independent verification. Nothing contained herein constitutes investment, legal, tax, or other advice nor is it to be relied on in making an investment or other decision. This publication should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell securities or to adopt any investment strategy. The views expressed here are the author’s own and do not reflect the views of The Rockefeller Foundation.