With population growth, economic development, and climate change, water is increasingly scarce in many regions of the world. There is a need to improve water management, how water is distributed among its competing uses, and how productively it is used. We need to do more with less if we want to achieve water-neutral growth and keep growing without increasing our water use. Water markets have the potential for improving water’s allocation, and are increasingly used and promoted in the United States, Australia, Chile, and elsewhere. The price signals they send could also trigger a more flexible and decentralized response to droughts and changing environmental and economic conditions, which could make societies more resilient. [1]

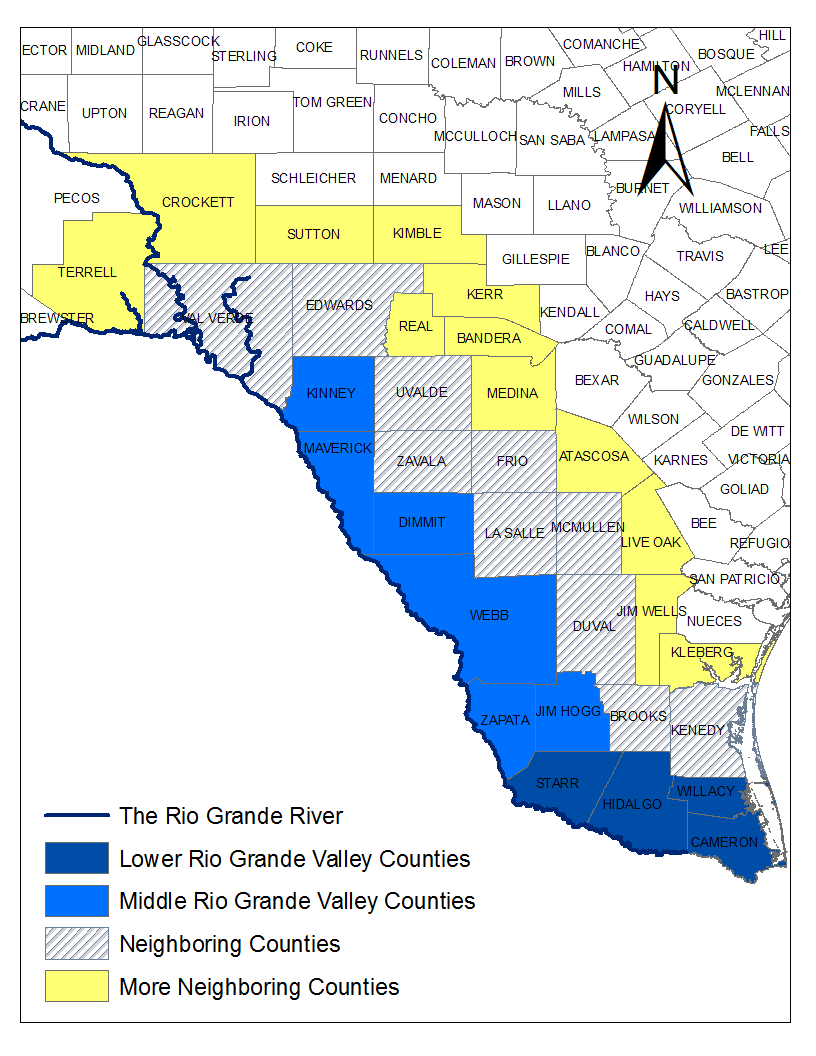

Water markets are cap-and-trade systems in which the rights to use water are bought, sold, or leased independent of the land title. Their appeal is that they should bring about a more efficient water allocation. Those who can use water most productively at the margin are expected to buy water, whereas marginally less-productive users should sell. Hence, a key prediction is that markets on average lead to more productive uses (i.e. higher average dollar of revenue per water used). To investigate this central prediction, we recently studied the Rio Grande water market in Texas.[2] It is one of the most established water markets in the United States that operates along the lower and middle reaches of the Rio Grande, which stretches from Colorado to the Gulf of Mexico (see Figure 1A), constituting the border with Mexico for 1,200 miles. As one of the oldest markets it has sufficient, albeit relatively aggregate, time-series data that allow us to compare the most productive crop categories, fruits and vegetables, with all other crops grown in the area.

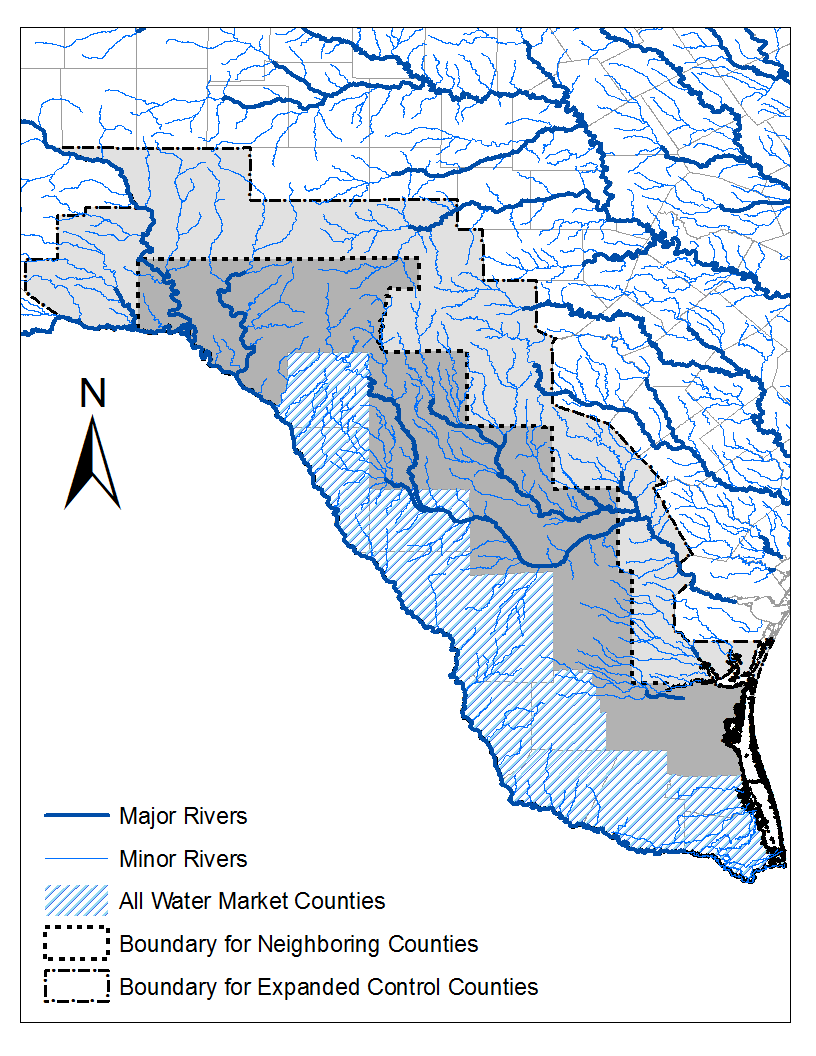

NOTE: The county boundary shapefile data come from the University of Minnesota Population Center. National Historical Geographic Information System: Version 2.0. 2011. http://www.nhgis.org. The river shapefile data come from National Weather Service GIS—AWIPS Shapefile Database.

Moreover, because of the relatively long time period, there is also sufficient variation in the weather conditions in order to assess the impact of droughts on the operation of water markets.

After several lengthy lawsuits, the Texas attorney general paved the way for the creation of the water market in late 1960s, aiming to ensure sufficient water supply for a growing population and to prevent that water districts, private corporations, or individuals from diverting too much from the lower Rio Grande. Before priority by seniority governed water use and it still does in most of Texas, and the western United States. In case of a drought, older water rights holders used to retain their privileged access even if they used water less productively. With the water market, seniority was abandoned in the water-market counties, so that farmers in those counties could be more flexible than surrounding counties. Water could be reallocated to whomever is willing to pay most. Hence, the effects that we identify are by default tied to the changing legal framework that made the water market possible

The region’s scarcity makes water a valuable resource, creating an incentive to trade water rights, especially as there are expanding cities whose average water productivity is high compared to agriculture, as well as a wide variety of crops within agriculture. The area’s topography also supports the market’s persistence. Much of the diverted water does not return to the Rio Grande, limiting potential (negative) externalities. Add to this the predominance of surface water, rights to which are better defined than are rights to groundwater. Finally, there is the Rio Grande Water Office that brokers deals. Paperwork and negotiation costs are fixed and low. Spot-market transactions in agriculture can be processed within one day, as they do not involve a change of water rights. [3]

We study whether the composition of the crops that are grown in the water-market counties changes compared to the non-market control counties after the market is established. We thus adopt a widely-used difference-in-differences empirical model. Tto our knowledge, ours is the first quasi-experimental analysis to investigate the actual impact of water markets on production. Without a randomized control trial, finding appropriate control counties is challenging, because the exact counterfactual (the water-market counties without a water market) does not exist. We choose as control counties for our water market counties, the neighboring counties along the Rio Grande or the Nueces, a comparable river. Our water market includes 10 counties at the lower and middle portions of the Rio Grande (see Figures 1A and B). Since the river constitutes the border with Mexico, we only use the eastern US neighbor counties as controls. We choose neighboring control counties that have similar climatic conditions due to their proximity to the treated counties, and find that the treatment and control areas are statistically similar in terms of counties’ river length, soil capacity classes, as well as most of related agricultural characteristics in the pre-market years. In addition, we also control for the effect of potential confounding factors, to the extent possible, including a whole battery of county, crop and year effects, and other variables such as population growth, urbanization, precipitation and temperature variables.

We find evidence that markets indeed increase the share of crops that are, on average, more productive in terms of revenue generated per water used. Upon closer inspection, this effect is most pronounced when there is a drought, i.e. when water is the scarcest and its opportunity cost the highest. Therefore, in light of mounting water challenges, water markets may be able to help us achieve more economic growth with less water resource use.

Tianshu Li is an assistant professor at Nanjing Audit University, and UVA graduate and Darden postdoc.

References

Chang, C. and Ronald C. Griffin, 1991, Water marketing as a reallocative institution in Texas, Water Resources Research, Vol. 28, 3, p. 879-890.

Debaere, Peter and Tianshu Li, 2020, “The Effects of Water Markets: Evidence from the Rio Grande” Advances in Water Resources, 145 (2020) 103700. https://doi.org/10.1016/j.advwatres.2020.103700

Dinar, A, Pochat, V. and J. Albiac-Murillo, (eds.) 2015, Water Pricing, Experiences and Innovations, Springer International Publishing, Switzerland.

Knapp, K., Weinberg, M., Howitt, R., and Posnikoff, J., 2003, Water transfers, agriculture, and groundwater management: a dynamic economic analysis, Journal of Environmental Management, 67,4, 291-301.

Leidner, A., M. Rister, R. Lacewll, and A. Sturdivant, 2011, The water market for the middle and lower portions of the Texas Rio Grande Basin, Journal of the American Water Resources Association, p. 1 – 14.

Lixia, H. and T. Horbulyk, 2010, Market-based policy instruments, irrigation water demand, and crop diversification in the Bow River basin of Southern Alberta, Canadian Journal of Agricultural Economics, 58, 2, 191-213.

Olmstead, Sheila, 2010, The economics of managing scarce water resources, Review of Environmental Economics and Policy 4(2), 2010: 179-198.

Schoolmaster, F. Andrew, 1991, Water Marketing and Water Rights Transfers in the Lower Rio Grande Valley, Texas, The Professional Geographer, Vol. 43 (3), p. 292-304.

Yoskowitz, D., 1999, Spot Market for Water along the Texas Rio Grande: Opportunities for Water Management, Natural Resources Journal, 39, p. 345-355.

[1] Dinar et al. (2015) survey existing water-pricing policies worldwide. Olmstead (2010) emphasizes the role of price adjustments in quelling existing concerns of the limits-to-growth debate of the 1970s.

[2] Debaere, Peter and Tianshu Li, 2020, “The Effects of Water Markets: Evidence from the Rio Grande” Advances in Water Resources, 145 (2020) 103700. https://doi.org/10.1016/j.advwatres.2020.103700

[3] Leidner et al. (2011), Schoolmaster (1991), Chang and Griffin (1991).